The document, entitled Ex Post Evaluation of Exceptional Access Under the 2010 Stand-By Arrangement (henceforth referred to as the Evaluation Document), does not mince its words, and suggests that Greece suffered a worse than necessary recession due to the reluctance of Europe's leaders to agree on debt restructuring from the outset. The reason for this reluctance is obvious with hindsight, the Euro Area was institutionally ill-prepared for the kind of crisis which was unfolding while the interconnection of the European capital markets and the banking sectors meant the financial systems of a number of other European countries were at risk.

Contagion from Greece was a major concern for euro area members given the considerable exposure of their banks to the sovereign debt of the euro area periphery.

Earlier debt restructuring could have eased the burden of adjustment on Greece and contributed to a less dramatic contraction in output. The delay provided a window for private creditors to reduce exposures and shift debt into official hands. This shift occurred on a significant scale and left the official sector on the hook.

An upfront debt restructuring would have been better for Greece although this was not acceptable to the euro partners. A delayed debt restructuring also provided a window for private creditors to reduce exposures and shift debt into official hands. As seen earlier, this shift occurred on a significant scale and limited the bail-in of creditors when PSI eventually took place, leaving taxpayers and the official sector on the hook. - IMF Evaluation Document

The contents of the Evaluation Document were widely reported on in the press (see for example here), and produced a swift response from EU Commission representatives, including an "I don't think it's fair and just that (the IMF) is trying to wash its hands and throw dirty water on European shoulders," from Economic and Monetary Affairs Commissioner Olli Rehn. The little phrase that caused all the problems was the report's assertion that "An upfront debt restructuring would have been better for Greece although this was not acceptable to the euro partners." Obviously, when a dispute becomes as public as this, something, somewhere is going on. Trying to fathom what it was I couldn't help noticing that the publication of the Evaluation Document coincided almost exactly in timing with the issuing of the Fund's latest report on the current (rather than the initial) Greek programme - The Third Review Under the Extended Arrangement Under the Extended Fund Facility (what a mouthful that is, henceforth the Third Review) - where curiously the international lenders let slip the significant little detail that next year Greece is expected to have a funding shortfall of some 4 billion Euros. Almost immediately denials that any kind of talks were ongoing about any kind of forthcoming debt pardoning for the country started to surface in Germany, (or see here).

In my case the light dawned when reading more thoroughly through the Third Review document I came across the following paragraph:

The macroeconomic outlook, debt service to the Fund, and peak access remain broadly unchanged and euro area member states remain committed to an official support package that will help keep debt on the programmed path as long as Greece adheres to program policies. Capacity to repay the Fund thus depends on the authorities’ ability to fully implement an ambitious program. It continues to be the case that if the program went irretrievably off-track and euro area member states did not continue to support Greece, capacity to repay the Fund would likely be insufficient.Now all of this may sound - at least to the uninitiated - like a load of old bureaucratic mumbo-jumbo, but actually there are a number of key statements here which may help to put the recent internal Troika tiff in some sort of broader and more intelligible perspective.

Sometimes in order to get to grips with a highly complicated argument thread it helps to go to the endpoint and then work your way back. It also helps to bear in mind that the recent Evaluation Document is as much about the future as it is about the past - and in particular the scenario which will come into play in 2020 and 2022 when the current programme's debt to GDP targets are expected to be achieved.

The cited paragraph talks about three issues: the macroeconomic outlook, the commitment of euro area member states to support Greece and keep the debt on the programmed path as long as Greece adheres to the programme's requirements, and the danger that should the programme go "irretrievably off track", and euro area member states not give the necessary support then the country's capacity to repay the Fund would clearly be insufficient - ie the IMF would be left holding the can, and Fund employees would be faced with the complicated task of explaining to its non-European members why losses had been incurred.

So now I understand the nervousness a bit better. Crudely put the position is this - as long as the IMF continue to write reviews stating the Greek programme is on track then the euro area member states are on the hook to make up any shortfall in Greek debt performance. This is a commitment they undertook during negotiations on the second bailout agreement.

On the other hand, if the IMF were to start producing reports stating that the programme was off-track because of Greek non-compliance, rather than for example arguing that the numbers were out of whack due to faulty macroeconomic forecasts (some of them from the EU Commission itself), then the euro area member states would be off the hook from additional stepping up to the plate with the result that the IMF would end-up taking a loss.

Complicated isn't it? That is why the rule of starting out from the assumption that nothing is ever exactly what it seems to be is normally a good one to work by.

What is obvious from reading through the documentation is that the IMF is keen to highlight the guarantees given by Greece's euro area peers at the time of setting up the Extended Fund Facility (2012) that "adequate support" would be provided to bring Greece's debt down below 110% of GDP in 2022 (ie that there would be some form of debt pardoning) should the country comply with the terms of its programme and the debt dynamics still not turn out right. Since we now have a track record on all this, and since staff economists at the Fund have also recently conducted a debt sensitivity analysis which came up with the finding that given slight under-performance on GDP and inflation outcomes the debt could still be as high as 147% of GDP come 2022 , the issue is no mere trifle.

This is, in my opinion, why so much emphasis is now being placed in Washington on the fact that Greece's short term interests were to some extent sacrificed for the greater good of the eurozone, a justification which may make the bitter pill of Euro-partner losses on their loans to Greece easier to sell to their respective electorates.

Well, since nothing is really valid in this world until it is tested (like the June 2012 commitment to mutualise some of Spain's bank losses), and since 2020 is still a relatively long way away, it isn't hard to understand why the good folks in Washington might want to see the commitment in Europe tested a good deal sooner, which is where, I think, next year's 4 billion euro funding shortfall comes in. I cite the latest review document (my emphasis):

A Deeper Than Necessary Recession?

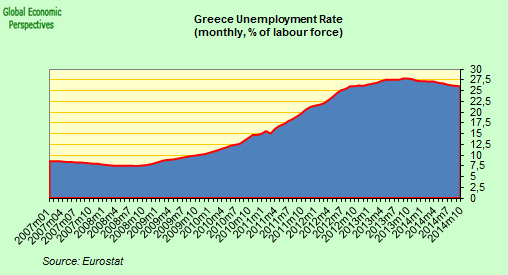

Greece's recession has been one of the deepest peacetime recessions ever experienced in industrialized economies, and bears comparison with the great depressions of the 1930s in the US and Germany (see chart prepared by the IMF below). Overall, the economy contracted by 22 percent between 2008 and 2012 and unemployment rose to 27 percent; youth unemployment now exceeds 60 percent. As domestic demand shrank across all areas, net exports provided support largely through shrinking imports. Indeed as opposed to other countries on Europe's periphery exports actually shrank in Greece in both 2011 and 2012. The issue this raises is was such devastation really necessary in a country participating in a currency union which could have expected support from other participants?

Naturally the country "cheated" on its partners, and sacrifices were inevitable but surely a more pragmatic and equitable solution could have been found. Simply punishing a country for what is perceived to have been "wrong doing" accomplishes little and may put a great deal at risk, including amongst those not directly involved.

As the IMF points out in the Third Review, Greece was forced into one of the largest fiscal adjustments seen anywhere to date (see chart below).The primary adjustment in 2010–12 amounted to 9 percent of GDP, and was much higher (15 percent of GDP) in cyclically-adjusted terms. The same outcome could have been achieved over a slightly longer period of time had a more constructive attitude been taken. On the other hand the IMF take the view that some sort of rapid fiscal adjustment was unavoidable (but how rapid?) given that the Greece had lost market access and official financing could be considered to have been as large as politically feasible. They conclude:

One of the key points to note here is the observation that the program only ran through mid-2013. This is a knock-on consequence of the type of program originally set up (the so-called Standby Arrangement - or SBA). SBA's are by their very nature designed and intended for short term liquidity support prior to a reasonably rapid return to market access. But Greece's needs, as is now obvious, were longer term and involved solvency issues. Had a decision been taken at the outset to set up an Extended Funding Facility (the 2012 program is of precisely this type) then the time horizon could have been longer, but part of the reason an EFF was not chosen was because the solvency issue was not recognised and debt restructuring was not on the table, so the argument at this point becomes somewhat circular. That is to say, had the will been there at the outset to use an Extended Funding Facility and had the realistic view (recognized with hindsight) that debt restructuring was inevitable been taken, then the Greek fiscal correction would still have been significant, but more extended in time, and with less overall damage to the economy's private sector.

And the damage was severe. The employment loss was dramatic (see chart) and as in other countries who have suffered a similar, if more benign, fate (Spain, Portugal) it is hard to see how earlier levels are ever going to be recovered given anticipated future growth rates.

The social and economic consequences of the over ambitious fiscal correction have gone well beyond the downsizing of the country's bloated public sector, and no part of Greek society has been spared. Among Greek households the fall in disposable income between 2009 and 2011 nearly doubled the previous debt-to-disposable-income ratio (which rose to 96 percent - higher than the peak observed in Latvia). Falling property prices have raised mortgage loan-to-value ratios from around 70 percent on average before the crisis (lower than in European peers) to close to 90 percent in 2012 (currently higher than even in Spain). House prices fell by 11.8% in the year to the end of March, according to the residential price index published by realtors Knight Frank following a 9.8% drop a year earlier. For a country which didn't really have a property boom before the crisis this is very striking.

In the non-financial corporate sector the decline in profits has affected firms’ ability to service debt, with the interest coverage ratio dropping from 24 percent in 2001 (one of the highest in Europe) to 2.4 percent in 2012 (higher only than Portugal). As a result Non-performing loans in both the household and corporate sectors have risen sharply (see chart below for the corporate case) and in 2013 are expected to pass the 30% of total loans mark.

All this distress and impairment naturally creates problems where previously few existed. The Euro firewall building process meant that most of Greece's sovereign debt risk was transferred from other European banks to Greek ones, with the consequence that when the debt restructuring finally did come these banks all needed recapitalizing by the state leading the country to have to borrow yet more money to pay for this. Now that the only external imbalance correction process is what the IMF calls the "recessionary path" (rather than a more comprehensive internal devaluation - see below) these same banks are being faced with substantially more losses on their general loan books, possibly leading to the need for yet more recapitalization, and so on.

Divergences Within The Troika On Deflation?

Leaving aside a small quibble about the definition of deflation Mario Draghi selects for himself - for self-fulfilling expectations about an ongoing fall in prices to set in prices first need to start falling - there is no doubt that in the case of Greece prices are now falling, and the arrival of this crude kind of deflation (rather than what we could call the Draghi variety) in any country is surely an issue which most of the world's central bankers beyond the confines of the ECBs governing council are certainly not blasé about, if only because unless it is handled properly it can transform itself into the kind Mr Draghi so rightly fears . According to the IMF Third Review

But the IMF are concerned about an ongoing fall in wages and incomes in the context of continuing increases in the price level, and hence welcome the drop in prices as part of an internal devaluation which is seen as essential to restore international competitiveness.

So why might the other parts of the Troika - the EU Commission and the ECB - be more nervous about the consequences of this drop in the price level? They are concerned about the impact on Greek debt dynamics is the obvious answer. This drop in prices is now seen as essential and inevitable by the Fund, but is still to some extent being resisted in Brussels and Berlin. Again, the reason for the reticence is obvious, "we're on the hook" - remember, if Greek debt is above the 110% of GDP target in 2022, or reaches levels in the intervening years that make this level obviously unattainable, for reasons of lower than anticipated GDP or price growth then the Euro Area peer countries are committed to making up the difference.

The chart below shows the results of a Debt Sustainability Analysis carried out by Fund economists during the period of the first bailout. What is clear is that the two main risk items for debt snowballing are lower than anticipated GDP growth and deflation. As the IMF itself observes in the Evaluation Document: Since the shocks considered were fairly mild, this sensitivity analysis demonstrated the precariousness of the debt trajectory. For example, the deflation shock considered in the DSA (3 percent more) would not have made much difference to the internal devaluation, but would have caused debt to jump to 175 percent of GDP.

In the Third Review the Fund goes even further on the basis of a new Debt Sustainability analysis - "If nominal growth averages 1 percent lower than the 4 percent baseline projection, debt will be 134 percent in 2020 with an only modest declining path thereafter". That is to say, if the sum of GDP growth and inflation is 1% less than forecast in the baseline scenario debt will rise substantially.

So Whither Greece? Is Grexit About To Become An Option Again?

According to Citi's Chief Economist Willem Buiter, the man who coined the term Grexit, the possibility of Greece exiting the euro zone has receded "markedly" in recent months. "We still believe that there is a fairly high risk of Grexit in coming years, but no longer put it in our base case at any particular date," Citi said in a research note co-authored by Buiter published in May. Reading this assessment at the time of its publication the argument seemed reasonable to me. But after 48 hours of poring over IMF documentation on the country I am no longer so sure that this conclusion is as solid as it seems.

My feeling now is that, despite Buiter's recent pronouncements, Grexit may well come rapidly back on the agenda after the German elections. I think markets are soothing themselves with an overoptimistic expectation of how committed German politicians are to moving towards banking and fiscal union - Draghi bond buying at the ECB is another issue, but the Greeks by and large don't have bonds to sell, they just have debt obligations to the official sector. Put another way, as Wolfgang Munchau argues in this week's Financial Times, “The OMT is not designed to address the solvency problems of various private and public entities in the eurozone”, and Greece's coming problems are surely of the solvency and not the liquidity kind.

The key issue really hangs around the obligations the Euro partners entered into with the IMF last December to fund any shortfall in Greek funding and debt-reduction needs as long as the IMF continues to give the country a pass mark during the ongoing reviews.

Looking over and over again through the numbers the IMF put forward it is clear to me that there is really very little wiggle room left on Greek debt dynamics, and that the IMF are fully aware of this as their Debt Sustainability exercises demonstrate, hence initial attempts to distance themselves from EU institutions in the Evaluation Document. The move reminds me of one of Leo Messi's attempts to lose his markers while languishing near the edge of the penalty box. One swift lunge and its in the net.

Now one possibility which lies before us is obviously that the IMF gives the country a red flag in a review. That wouldn't be so difficult given the way Greece works. Yet actually, for reasons discussed in the introductory section to this piece, the Fund has precious little interest in doing this, since the country's Euro peers could then simply walk away from their funding obligations and the IMF would be last man standing on the debt, a situation they repeatedly stress they are anxious to avoid. Nonetheless, let us assume they do throw up a red flag, what would be the consequences?

Well, not another EU backed aid programme surely. The red flag would mean the issue of possible Grexit would be directly back on the table, since core Europe would surely be extremely reluctant to accept politically unpopular losses for a country that wasn't complying, and it is hard to see what the solution to ongoing funding shortfalls coupled with non-compliance would be if it wasn't euro exit.

So now let's assume that the country gets a series of continuing green flags, but that nominal GDP performance is less than projected in the programme's baseline scenario - it may not be politically correct to say this, but it is hard not to get the impression that the inflation and growth numbers for 2015 to 2018 (showing nominal GDP growth of around 4.7%) have been devised explicitly to bring Greek debt into the region of 120% by 2020, at least on paper. The probability of under-performance is thus high.

Cognizant of this looming difficulty the Fund seem to be already attempting to force the issue by looking for a 4 billion Euro down-payment on their commitment from the Euro partners in 2014. Then, supposing they wanted to accelerate the Euro partners Greek bail-in process they would only have to revise down their post 2014 inflation and GDP forecasts to make even more money needed quite quickly. But, if we think about it a bit, the political logic for ongoing debt pardoning in Greece by other EU member states isn't especially clear given that Italy, Portugal, Ireland and Spain could all easily have debt levels over 110% of GDP come 2022. So how can you justify making Greece a special case in the positive sense? I think the more likely outcome is that core Europe will try to wriggle out of its obligations following the German elections, and that this move will lead to a surge in uncertainty about Greece's future, with Grexit once more becoming an openly discussed option.

The cited paragraph talks about three issues: the macroeconomic outlook, the commitment of euro area member states to support Greece and keep the debt on the programmed path as long as Greece adheres to the programme's requirements, and the danger that should the programme go "irretrievably off track", and euro area member states not give the necessary support then the country's capacity to repay the Fund would clearly be insufficient - ie the IMF would be left holding the can, and Fund employees would be faced with the complicated task of explaining to its non-European members why losses had been incurred.

So now I understand the nervousness a bit better. Crudely put the position is this - as long as the IMF continue to write reviews stating the Greek programme is on track then the euro area member states are on the hook to make up any shortfall in Greek debt performance. This is a commitment they undertook during negotiations on the second bailout agreement.

On the other hand, if the IMF were to start producing reports stating that the programme was off-track because of Greek non-compliance, rather than for example arguing that the numbers were out of whack due to faulty macroeconomic forecasts (some of them from the EU Commission itself), then the euro area member states would be off the hook from additional stepping up to the plate with the result that the IMF would end-up taking a loss.

Complicated isn't it? That is why the rule of starting out from the assumption that nothing is ever exactly what it seems to be is normally a good one to work by.

What is obvious from reading through the documentation is that the IMF is keen to highlight the guarantees given by Greece's euro area peers at the time of setting up the Extended Fund Facility (2012) that "adequate support" would be provided to bring Greece's debt down below 110% of GDP in 2022 (ie that there would be some form of debt pardoning) should the country comply with the terms of its programme and the debt dynamics still not turn out right. Since we now have a track record on all this, and since staff economists at the Fund have also recently conducted a debt sensitivity analysis which came up with the finding that given slight under-performance on GDP and inflation outcomes the debt could still be as high as 147% of GDP come 2022 , the issue is no mere trifle.

This is, in my opinion, why so much emphasis is now being placed in Washington on the fact that Greece's short term interests were to some extent sacrificed for the greater good of the eurozone, a justification which may make the bitter pill of Euro-partner losses on their loans to Greece easier to sell to their respective electorates.

Well, since nothing is really valid in this world until it is tested (like the June 2012 commitment to mutualise some of Spain's bank losses), and since 2020 is still a relatively long way away, it isn't hard to understand why the good folks in Washington might want to see the commitment in Europe tested a good deal sooner, which is where, I think, next year's 4 billion euro funding shortfall comes in. I cite the latest review document (my emphasis):

The program is fully financed through the first half of 2014, but a projected financing gap of €4 billion will open up in the second half of 2014. Thus, under staff’s current projections, additional financing will need to be identified by the time of the next review, to keep the program fully financed on a 12-month forward basis, and the Eurogroup has initiated discussions already on how to eliminate the projected 2014 gap. In this regard, the Eurogroup commitment made in both February and November 2012 to provide adequate support to Greece during the life of the program and beyond, provided that Greece fully complies with the program, is particularly important.Again the essentials are hard to-get-through-to for all the bureaucrat-speak, but the last sentence says it all - "The Eurogroup Commitment...to provide support to Greece....is particularly important."

A Deeper Than Necessary Recession?

Greece's recession has been one of the deepest peacetime recessions ever experienced in industrialized economies, and bears comparison with the great depressions of the 1930s in the US and Germany (see chart prepared by the IMF below). Overall, the economy contracted by 22 percent between 2008 and 2012 and unemployment rose to 27 percent; youth unemployment now exceeds 60 percent. As domestic demand shrank across all areas, net exports provided support largely through shrinking imports. Indeed as opposed to other countries on Europe's periphery exports actually shrank in Greece in both 2011 and 2012. The issue this raises is was such devastation really necessary in a country participating in a currency union which could have expected support from other participants?

Naturally the country "cheated" on its partners, and sacrifices were inevitable but surely a more pragmatic and equitable solution could have been found. Simply punishing a country for what is perceived to have been "wrong doing" accomplishes little and may put a great deal at risk, including amongst those not directly involved.

As the IMF points out in the Third Review, Greece was forced into one of the largest fiscal adjustments seen anywhere to date (see chart below).The primary adjustment in 2010–12 amounted to 9 percent of GDP, and was much higher (15 percent of GDP) in cyclically-adjusted terms. The same outcome could have been achieved over a slightly longer period of time had a more constructive attitude been taken. On the other hand the IMF take the view that some sort of rapid fiscal adjustment was unavoidable (but how rapid?) given that the Greece had lost market access and official financing could be considered to have been as large as politically feasible. They conclude:

It is difficult to argue that adjustment should have been attempted more slowly. The required adjustment in the primary balance, 14½ percentage points of GDP, was an enormous adjustment with relatively few precedents, but was the minimum needed to bring debt down to 120 percent by 2020. Moreover, despite the starting point being slightly worse than thought to be the case when the 2010 Stability Program was drawn up, the SBA-supported program had already extended the period over which the Maastricht deficit target would be achieved from 3 to 5 years. Since the program only ran through mid-2013, the last part of this adjustment would occur after the program and the conditionality had ended. Moreover, debt would still be increasing when the program ended.

One of the key points to note here is the observation that the program only ran through mid-2013. This is a knock-on consequence of the type of program originally set up (the so-called Standby Arrangement - or SBA). SBA's are by their very nature designed and intended for short term liquidity support prior to a reasonably rapid return to market access. But Greece's needs, as is now obvious, were longer term and involved solvency issues. Had a decision been taken at the outset to set up an Extended Funding Facility (the 2012 program is of precisely this type) then the time horizon could have been longer, but part of the reason an EFF was not chosen was because the solvency issue was not recognised and debt restructuring was not on the table, so the argument at this point becomes somewhat circular. That is to say, had the will been there at the outset to use an Extended Funding Facility and had the realistic view (recognized with hindsight) that debt restructuring was inevitable been taken, then the Greek fiscal correction would still have been significant, but more extended in time, and with less overall damage to the economy's private sector.

And the damage was severe. The employment loss was dramatic (see chart) and as in other countries who have suffered a similar, if more benign, fate (Spain, Portugal) it is hard to see how earlier levels are ever going to be recovered given anticipated future growth rates.

The social and economic consequences of the over ambitious fiscal correction have gone well beyond the downsizing of the country's bloated public sector, and no part of Greek society has been spared. Among Greek households the fall in disposable income between 2009 and 2011 nearly doubled the previous debt-to-disposable-income ratio (which rose to 96 percent - higher than the peak observed in Latvia). Falling property prices have raised mortgage loan-to-value ratios from around 70 percent on average before the crisis (lower than in European peers) to close to 90 percent in 2012 (currently higher than even in Spain). House prices fell by 11.8% in the year to the end of March, according to the residential price index published by realtors Knight Frank following a 9.8% drop a year earlier. For a country which didn't really have a property boom before the crisis this is very striking.

In the non-financial corporate sector the decline in profits has affected firms’ ability to service debt, with the interest coverage ratio dropping from 24 percent in 2001 (one of the highest in Europe) to 2.4 percent in 2012 (higher only than Portugal). As a result Non-performing loans in both the household and corporate sectors have risen sharply (see chart below for the corporate case) and in 2013 are expected to pass the 30% of total loans mark.

All this distress and impairment naturally creates problems where previously few existed. The Euro firewall building process meant that most of Greece's sovereign debt risk was transferred from other European banks to Greek ones, with the consequence that when the debt restructuring finally did come these banks all needed recapitalizing by the state leading the country to have to borrow yet more money to pay for this. Now that the only external imbalance correction process is what the IMF calls the "recessionary path" (rather than a more comprehensive internal devaluation - see below) these same banks are being faced with substantially more losses on their general loan books, possibly leading to the need for yet more recapitalization, and so on.

Divergences Within The Troika On Deflation?

"Deflation is a protracted fall in prices across different commodities, sectors and countries. In other words, it is a generalised protracted fall in prices, with self-fulfilling expectations. Therefore, it has explosive downward dynamics. We do not see anything like that in any country". Mario Draghi answering the question "do you see any risk of deflation in some countries in the euro area?" at this months ECB press conference

"Macroeconomic developments are broadly as expected. The economy is rebalancing apace: the current account deficit is now shrinking fast, by 6½ percent of GDP in 2012; the competitiveness gap has been reduced by about half as last year’s labor market reforms are facilitating significant wage adjustment; and deflation is finally setting in". - IMF Third Programme Review (my emphasis).

Leaving aside a small quibble about the definition of deflation Mario Draghi selects for himself - for self-fulfilling expectations about an ongoing fall in prices to set in prices first need to start falling - there is no doubt that in the case of Greece prices are now falling, and the arrival of this crude kind of deflation (rather than what we could call the Draghi variety) in any country is surely an issue which most of the world's central bankers beyond the confines of the ECBs governing council are certainly not blasé about, if only because unless it is handled properly it can transform itself into the kind Mr Draghi so rightly fears . According to the IMF Third Review

In response to Greece’s now high output gap, headline HIPC inflation fell to 0.3 percent at end-2012 (from over 2 percent at end-2011) and turned negative in March (-0.2 percent) and April (-0.6 percent). Core inflation (excluding energy and unprocessed food), which has been negative for some time, fell further to -1¼ percent in March. The GDP deflator also turned negative in 2012 (-¾ percent).The striking thing, leaving aside the issue of definition, is that the IMF actually seem to welcome the fact deflation is finally arriving in Greece - due to the competitiveness impact it will have on the Greek price level. But it is here I think that one can discern some sort of difference of opinion within the Troika itself. It seems likely that the IMF would actually agree with Mario Draghi that Japanese-style deflation is probably not on the cards in Greece at the moment (although given the depth of the country's problems and the fact that the countries workforce has now started shrinking - due to demographic shifts and emigration - who the hell really knows, I certainly wouldn't put my hand in the fire one way or the other on this one).

But the IMF are concerned about an ongoing fall in wages and incomes in the context of continuing increases in the price level, and hence welcome the drop in prices as part of an internal devaluation which is seen as essential to restore international competitiveness.

The far-reaching labor market reforms put in place in early 2012 have contributed to deeper wage corrections than in other recent crisis cases and substantial adjustment in the ULC-based REER. Less encouraging has been the weak and delayed response of prices to wage reductions, owing largely to product market rigidities. This asymmetry in price adjustment has led to a substantial erosion in real incomes and demand, and placed a disproportionate burden on wage earners relative to the self employed and the corporate sector. It has also left the CPI-based REER overvalued in 2012 by about 9 percent (Box 2). With the headline inflation now in negative territory and a widening inflation differential with the euro area, the extent of overvaluation is gradually reducing and relative prices between the tradable and nontradable sectors are adjusting. - IMF 2013 Article IV Consultation

So why might the other parts of the Troika - the EU Commission and the ECB - be more nervous about the consequences of this drop in the price level? They are concerned about the impact on Greek debt dynamics is the obvious answer. This drop in prices is now seen as essential and inevitable by the Fund, but is still to some extent being resisted in Brussels and Berlin. Again, the reason for the reticence is obvious, "we're on the hook" - remember, if Greek debt is above the 110% of GDP target in 2022, or reaches levels in the intervening years that make this level obviously unattainable, for reasons of lower than anticipated GDP or price growth then the Euro Area peer countries are committed to making up the difference.

The chart below shows the results of a Debt Sustainability Analysis carried out by Fund economists during the period of the first bailout. What is clear is that the two main risk items for debt snowballing are lower than anticipated GDP growth and deflation. As the IMF itself observes in the Evaluation Document: Since the shocks considered were fairly mild, this sensitivity analysis demonstrated the precariousness of the debt trajectory. For example, the deflation shock considered in the DSA (3 percent more) would not have made much difference to the internal devaluation, but would have caused debt to jump to 175 percent of GDP.

In the Third Review the Fund goes even further on the basis of a new Debt Sustainability analysis - "If nominal growth averages 1 percent lower than the 4 percent baseline projection, debt will be 134 percent in 2020 with an only modest declining path thereafter". That is to say, if the sum of GDP growth and inflation is 1% less than forecast in the baseline scenario debt will rise substantially.

So Whither Greece? Is Grexit About To Become An Option Again?

According to Citi's Chief Economist Willem Buiter, the man who coined the term Grexit, the possibility of Greece exiting the euro zone has receded "markedly" in recent months. "We still believe that there is a fairly high risk of Grexit in coming years, but no longer put it in our base case at any particular date," Citi said in a research note co-authored by Buiter published in May. Reading this assessment at the time of its publication the argument seemed reasonable to me. But after 48 hours of poring over IMF documentation on the country I am no longer so sure that this conclusion is as solid as it seems.

My feeling now is that, despite Buiter's recent pronouncements, Grexit may well come rapidly back on the agenda after the German elections. I think markets are soothing themselves with an overoptimistic expectation of how committed German politicians are to moving towards banking and fiscal union - Draghi bond buying at the ECB is another issue, but the Greeks by and large don't have bonds to sell, they just have debt obligations to the official sector. Put another way, as Wolfgang Munchau argues in this week's Financial Times, “The OMT is not designed to address the solvency problems of various private and public entities in the eurozone”, and Greece's coming problems are surely of the solvency and not the liquidity kind.

The key issue really hangs around the obligations the Euro partners entered into with the IMF last December to fund any shortfall in Greek funding and debt-reduction needs as long as the IMF continues to give the country a pass mark during the ongoing reviews.

Looking over and over again through the numbers the IMF put forward it is clear to me that there is really very little wiggle room left on Greek debt dynamics, and that the IMF are fully aware of this as their Debt Sustainability exercises demonstrate, hence initial attempts to distance themselves from EU institutions in the Evaluation Document. The move reminds me of one of Leo Messi's attempts to lose his markers while languishing near the edge of the penalty box. One swift lunge and its in the net.

Now one possibility which lies before us is obviously that the IMF gives the country a red flag in a review. That wouldn't be so difficult given the way Greece works. Yet actually, for reasons discussed in the introductory section to this piece, the Fund has precious little interest in doing this, since the country's Euro peers could then simply walk away from their funding obligations and the IMF would be last man standing on the debt, a situation they repeatedly stress they are anxious to avoid. Nonetheless, let us assume they do throw up a red flag, what would be the consequences?

Well, not another EU backed aid programme surely. The red flag would mean the issue of possible Grexit would be directly back on the table, since core Europe would surely be extremely reluctant to accept politically unpopular losses for a country that wasn't complying, and it is hard to see what the solution to ongoing funding shortfalls coupled with non-compliance would be if it wasn't euro exit.

So now let's assume that the country gets a series of continuing green flags, but that nominal GDP performance is less than projected in the programme's baseline scenario - it may not be politically correct to say this, but it is hard not to get the impression that the inflation and growth numbers for 2015 to 2018 (showing nominal GDP growth of around 4.7%) have been devised explicitly to bring Greek debt into the region of 120% by 2020, at least on paper. The probability of under-performance is thus high.

Cognizant of this looming difficulty the Fund seem to be already attempting to force the issue by looking for a 4 billion Euro down-payment on their commitment from the Euro partners in 2014. Then, supposing they wanted to accelerate the Euro partners Greek bail-in process they would only have to revise down their post 2014 inflation and GDP forecasts to make even more money needed quite quickly. But, if we think about it a bit, the political logic for ongoing debt pardoning in Greece by other EU member states isn't especially clear given that Italy, Portugal, Ireland and Spain could all easily have debt levels over 110% of GDP come 2022. So how can you justify making Greece a special case in the positive sense? I think the more likely outcome is that core Europe will try to wriggle out of its obligations following the German elections, and that this move will lead to a surge in uncertainty about Greece's future, with Grexit once more becoming an openly discussed option.