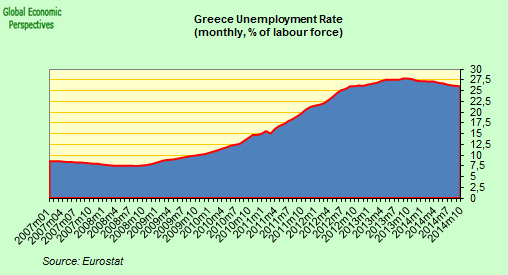

Oh yes, they also had elections in Greece, didn't they?

The most likely outcome, as far as I can see at the time of writing, is a neck and neck finish between the far left Syriza and the centre right New Democracy, with the key to the resolution of the outcome lying in the fact that whichever party comes first gets a bonus of an additional 50 seats. This will mean that if New Democracy do win, as it seems they have, they will probably be able to negotiate a deal with the other smaller parties (PASOK, for example) around some sort of face saving formula which will enable a government to be formed and a deal struck with Berlin.

On the other hand, if Syriza were to finally win no one has a clue what will happen. The party doesn't want to leave the Euro, but does want to reject the memorandum. The only problem is that the only parties Syriza could form a government with would most likely want out of the Euro too. So Syriza winning by a short head would seem to imply more elections, or... or.... some sort of pact. I vote for the latter.

I say this since I think even if Syriza were by some quirk now to win some sort of government or other would still be formed, even if it needs the military to rustle sabres in the background just to get everyone to concentrate on the issues in hand. In the game of brinksmanship which will now be played, Syriza can blackmail Berlin with the threat of instability and disorderly exit (even in opposition), while Berlin can dangle money, lot's of it I imagine, before their eyes, if only they agree to help form a government. The track record says that politicians normally, when faced with a serious punch up or going for the money will normally go for the money.

Naturally, the money I am talking here about involves EU funds, not men in black suits carrying suitcases, although if the recent 270 million fine accepted by Siemens for bribing Greek officials to obtain lucrative telecommunication contracts is anything to go by, we shouldn't rule the other possibility out entirely.

Actually Angela Merkel has already hinted at this sort of solution. "This is why it is so important that, in the Greek election tomorrow ... a result emerges in which those who form a government in future tell us, yes, we want to keep to the agreements," she told a meeting of party faithful in Darmstadt this weekend, "This is the basis on which Europe can prosper."

What the forthcoming Greek government needs to do, then, is say loudly and clearly in public that it will stick to the memorandum. Say in public mind you, not necessarily follow the statement through in practice. The phrase being asked for certainly isn't an Austinian performative, equivalent to saying "I do" in a wedding. In this case uttering the phrase does not constitute implementation. Another example of something which also does not constitute what the British philosopher JL Austin would have termed a performative would be the expression “I promise to pay the bearer on demand the sum of …” which appears on the back of UK bank notes, and is evidently not a promise, or even a lick. It is simply just another way of spilling ink.

So then, with the protocols safely out of the way, the real deal can be done. Francois Hollande is already talking about an EU growth programme of around 120 billion Euros. And the Financial Times has revealed this weekend that, "European officials are preparing to dangle a package of incentives in front of a new Greek government to convince it to stick to the country’s current bailout deal after Sunday’s high-stakes elections. The package would include further reductions in interest rates and extended repayment periods for bailout loans, as well as EU money to spur investments in Greek public works programmes through the European Investment Bank".

Naturally, and even in the best of cases, the future government of Greece will be weak, and the economic situation dire. So the agreement to be reached will only be a band aid, one which one hopes will hold until the bigger issues are faced up to over the summer. All that has been avoided this weekend is a disorderly rupture in Greece's relations with the EU and the IMF, and as I argued here, this outcome was never really very likely.

So Greece in the short term will be staying in the Euro, although I am not sure whether a majority of observers will necessarily regard this as good news, since clearly it only postpones some sort of day of reckoning or other.

Sigh Of Relief In Berlin

One venue where people will be unequivocally happy with the outcome is - although some may find this surprising - inside policy circles in Berlin. The reason for this is evident. Germany itself is at greater risk of fall out from the Greek election than even Greece itself is. Personally I think the upward trickle in German Bund yields we have been seeing over the last week or so is pretty significant. It is almost as if the market is beginning to prepare for a two stage scenario. The first stage would be Greek non exit. Then in a second stage, the EU would not be moving ahead of the curve fast enough, and the common curreny could disintegrate. Germany, as the creditor country who would not be paid, would be one of the biggest losers.

More interesting perhaps than 10 year Spanish yields hovering around 7% is the fact that German yields have also started rising, as have German CDS and the volume of German CDS being traded.

My interpretation of this is as follows. This situation can end in either of two ways. The Euro can disintegrate, or full political union can be put in place. In either case Germany's debt burden will increase. In addition the country is export dependent, and will be negatively effected by any event which damages the other Euro economies. Robin Wrigglesworth put it like this in the Financial Times.

Analysts said this was a worrying development, which indicated investors could be starting to prepare for two “tail-risks” – a break-up of the common currency bloc or moves towards fiscal union.“If we see a trend of periphery bonds, Bunds and the euro start to sell off simultaneously we’d move from concern to alarm,” said David Lloyd, head of institutional portfolio management at M&G Investments.

Estimates of just how much the Troika are on the hook for should Greece default vary, but a common number is somewhere in the 200 billion euro range. Of course, some of this would eventually be recoverable, one day, and assuming Greece were able to pay, but in the meantime (given the super senior status of the IMF participation) it is highly likely that governments and taxpayers in the other Euro Area countries would need to cover the shortfall, and this, to put it mildly, is unlikely to be popular with voters. Yet another reason for "fudge and muddle through".

There are three main sources of Troika exposure to Greece, bailout loans, sovereign bonds owned by the ECB, and liquidity provided to the Greek central bank thorugh the Eurosystem via what is known as Target2. According to estimates by Commerzbank analyst Christoph Weil, between loans and bond purchases Greece owes a total of €194bn, which breaks down into €22bn owed to the IMF, €53bn to Euro Area countries, €74bn to the EFSF and €45bn to the ECB. On top of this there are Target2 liabilities of the Greek central bank vis-à-vis the ECB - and indirectly to the German banks - to the tune of €104bn.

As long as the music is playing, you’ve got to get up and dance

It was in fact former Citigroup chief Charles Prince who used this expression to characterise why, in a highly leveraged bailout (sorry, buyout) market fund managers continued to play the game, but it could equally well describe the "in for a penny in for every shilling I've got" situation German policymakers now find themselves in.

One of the silliest ideas introduced into the present Euro debate is the idea that Germany has always been a reluctant party to the common currency, and that the monetary union has acted to the country's disadvantage. Lombard’s Chief Economist Alexander Dumas tells us, for example, that ‘what you’re actually dealing with here... is a German population which has had a rotten deal – and that’s why they’re all so angry’.

Dumas's view is interesting since it highlights two popular misconceptions. The first of these is that Germany has been a long suffering victim of the spendthrift policy of its Euro Area partners, and the second is that German household consumption is so weak due to a domestic policy of wage compression. Now if we take the former argument, in fact the German economy entered the common currency in very poor shape, on the back of mid 1990s credit and construction boom, and was forced to make a substantial transition at the end from being a consumer-credit- driven economy running a small current account deficit to being an export driven one, pushed forward on the back of a large current account surplus.

If you look at the above chart, it would seem hard to argue that Germany has had a really hard time of it after joining the Euro. Just think about it. Who was buying all those German exports which are reflected in those massive current account surpluses.

This point seems so obvious it is hard to believe some people are still capable of ignoring it. It is not as if there wasn't a lot of material around pointing to this pretty evident truth. A good example of this work are the two recent and highly stimulating essays by Citi economists, Nathan Sheets and Robert Sockin, who convincingly argue that German trade performance since the start of monetary union has been significantly boosted by having a currency which was valued significantly below the valuation it would have been subjected to had the country still been using the Deutsche Mark. As a result of this systematic undervaluation Germany’s external surpluses widened significantly, led by rapid export growth.

Sheets and Sockin use a simple econometric procedure to estimate that that European monetary union, coupled with the country’s extraordinary wage restraint, has resulted in a real effective exchange rate for Germany that is currently 15 to 20 percent lower than the one which would have prevailed if Germany had had its own floating currency. And naturally the weaker real exchange rate has provided a significant windfall for Germany’s export sector. They thus find that the lower German real exchange rate has lifted the country’s nominal trade surplus by roughly 4 percent of GDP (or €100 billion) annually and the real trade surplus by about 3 percent of GDP annually. In addition, since the outbreak of the Greek crisis, Euro weakness has meant that German exports have been in an almost uniquely privileged position to benefit from strengthening global demand in the emerging market economies.

The comparison with Japan is significant in this case, since as of December 2011, Japanese exports were still running at 8% below their pre-crisis high point, while German exports were about 7% above their pre-crisis high. Since the global financial crisis German exports to China have risen most strongly, while Japanese exports to China have virtually stagnated. What could be the explanation for this strange phenomenon, since evidently Japan has efficiently produced technologically-advanced products to sell? Well, the relative values of the two currencies the countries use might offer us some part of the explanation. From the start of 2007 to mid 2008, the Japanese yen was trading in the range of 0.06 – 0.065 to the Euro. At the start of 2012 it was trading at all time record levels of just over 0.1 to the Euro – that is the yen rose versus the Euro by over 60% in just three and a half years. What German policy makers might with good reason worry is that should their country go back to the Deutsche Mark a similar fate might well await them.

Naturally in June 2008 Japan’s currency was significantly under-valued, due to its habitual use as the “carry” funding currency of preference, while Germany’s currency is currently significantly under-valued (due to the impact of the sovereign debt crisis). In July 2008 Japan’s currency valuation spiked dramatically – rising by around 30% in 3 months – as the global financial crisis took its toll and the carry trade unwound. Since that time Japan’s currency has risen steadily (as has, for example the Swiss Franc) due to the country’s safe haven status. Naturally such a state of affairs only serves to exacerbate the country’s long running deflation problem.

Taking everything into account, surely it would not be unreasonable to suggest that a Euro unwind would lead any new German currency to surge dramatically in the aftermath just as the Japanese one did in 2008, and then continue its upward path for safe haven reasons. The key point is that in the age of the global financial accelerator currency movements have a strong non-linear component.

Gazing Into The Tea Leaves

I suspect events will pan out as follows. The Greek elections will give markets a mildly positive surprise, since the country will not immediately exit the Euro, nor will European money be cut off (the IMF is another matter). In fact, as I suggest above, more money may be sent to Greece than expected via EU structural funds, or the EU investment bank.

In the meantime measures will be put in place in the direction of a European banking system and closer fiscal union. But the pace will be slow, painfully slow, and much slower than markets need to see to be convinced that real changes are coming.

So German bond yields and CDS can continue to rise, and this will produce political strains in Germany. It is these tensions inside Germany that can become the undoing of the Euro, since if political pressures cause leaders to put a break on the integration process market pressures could become too great to withstand.

Thus the reason for this sudden rush to keep the Greeks happy is evident. Germany has done its sums, and found that it is at even greater risk of getting hit by fall-out from the Greek election than Greece itself is. The thing is the Germans have now cunningly boxed themselves into a corner, and whichever way things go their position can only become worse.

I think German policy from this point on will be increasingly dictated by a belated attempt to avoid just this sort of outcome, and that we will see evidence of this over the next couple of weeks. Far from being a threat, Francoise Hollande might even help get Merkel off the hook. On the other hand, Fernando Santos, the Portuguese coach who trains Greek national side, reportedly told the press his players' victory was more inspired by Greek history than by Angela Merkel. Well if I remember my Thucydides aright, most Greek cities fell to their opponents not in pitched battle, but via "informal negotiations" held somewhere close to an unguarded side gate. Talks to form a new government will start tomorrow.

This post first appeared on my Roubini Global Economonitor Blog "Don't Shoot The Messenger".

.png)