Financial journalists across the globe were both surprised and puzzled recently when they heard Christine Lagarde using a strange expression. "You know, it's not over until the fat lady sings, as the saying goes," she told bemused reporters at a press conference in Manilla. Which fat lady, and what does she sing must have been questions going through the heads of many of those present.

Further investigation would have lead them to discover that far from this being some new piece of feminine wisdom that the IMF DG wanted to transmit, the phrase in fact comes from the rather male world of business deals and contact-sport-commentators and is generally used to describe closely contested matches, or deals which won’t be struck till the final offer is actually made.

Ms Lagarde naturally had other things in mind. She was referring to the state of negotiations surrounding the latest Greek bailout review, prior to the handing over of that long awaited 31.5 billion euro tranche the country so badly needs to meet its ongoing commitments. The curious thing about the holdup in this case is that it isn’t the result of a stand-off between the Troika and the Greek government. Last week the Greek parliament passed the final set of budget decrees required by the international lenders to enable the transfer.

No, in this case the dispute is an “internal affair” between the rival parties which make up the Troika, and in particular between the German government and the IMF. The issue is how to leave Greek finances having at least the appearance of being on a stable and sustainable path, which in this case is defined as attaining a sovereign debt level of 120% of Greek GDP come 2020. Delaying the country’s fiscal objectives by 2 years effectively means putting back the theoretical attainment of that objective by the same amount of time - until 2022. Jean-Claude Juncker was willing, but the IMF is digging its heals in. Any new agreement, Ms Lagarde said as she left Manilla en route for Tuesday’s Brussels EU finance ministers meeting, should be "rooted in reality and not in wishful thinking.” Tut tut, Mr Juncker.

So whence this sudden hardening in the Funds position? Well, it may be just a coincidence, but the US elections are now over. Barack Obama need not now preoccupy himself with what a hypothetical exit by Greece from the Euro would do for his campaign. Non-European members of the Fund have long been chaffing at the bit over the extent of the “kid gloves” treatment so many apparently rich countries have been receiving, and have been arguing for a much more independent and tougher approach. Now with the US starting to shift its ground the balance of opinion has clearly changed.

Greece’s debt is evidently on an unsustainable path however you look at it. Just getting through to 2020 isn’t enough, since the following decade is going to be very challenging demographically for the struggling country. Greece needs either a much more substantial reduction in its debt levels, or a negotiated exit from the Euro.

Realists are now pushing this view, but realists are also pragmatic people, they recognize that Angela Merkel has elections looming in the autumn of 2013, and that she can only go so far at this point. So it is simply the principle of the thing that needs to be established now. We can all get down to the real details once Greece fails another review, possibly towards the end of 2013. What Christine Lagarde did make clear in Manilla is that being “rooted in reality” means is that the best way countries in the Euro Area can send a strong and credible signal they remain committed to Greece’s continuing Euro membership is by agreeing in some way shape or form - the formula doesn't matter - to reduce the debt Athens owes them.

As Deutsche Bank analyst Mark Wall so tactfully put it in his latest report on the situation, "The objective of the current round of decisions will be to 'kick the Greek can' beyond the German elections in September 2013".

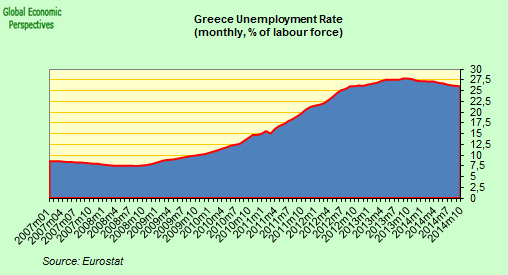

So it seems to me that later, after the German elections are over, the fuller implications of this initial signal of "realism" can be fleshed out. By that point Greece’s crisis-weary population will surely be ready for neither another year of substantial austerity cuts, nor for yet another year of recession, so a solution will need to be found. Unemployment will likely be over 27% at that point, and with people possibly being asked to grin and bear a seventh year of recession, we may well be rapidly closing in on a "just how much of this can you really stand" type situation.

If the debt pardoning cannot be great enough then Grexit will be on the table as a contemplatable solution. As Citi analyst Giada Giani puts it in the their latest report, "even if a return to a semblance of sustainability is agreed for the Greek debt and the next bailout tranche is released, we doubt this will be the deal that fixes Greece once and for all. We think a Grexit scenario still has a 60% probability of occurring in the next 12-18 months."

Calm Before the Storm?

So, the Euro Crisis is going to be effectively put on the back burner over the next nine months or so, or at least that is the hope in Berlin. Naturally there are no shortage of loose cannons that can come into play to make this hope just another example of what Lagarde calls “wishful thinking”, but even assuming everyone gets the time-out people are hoping for, just what is going to happen when the German election milestone is passed? To the external observer, it does look like fund managers from across the planet are being told one thing (that Germany will then take the bold steps which are so evidently needed to shore up the common currency) while German voters will be voting in the exact opposite belief, even to the extent perhaps of being lead to think that the OMT bond buying programme is merely temporary. So someone is going to be very badly disappointed, and not long from now market participants will have to start placing their bets on who they think that someone is going to be.

But to return to where we started, just who was that fat lady, and what exactly did she sing? Well deeper investigation into the world of urban legends reveals that the woman in question is none other than Brünnhilde, shieldmaiden and valkyrie in Norse mythology, as well as heroine in Wagner's famed and fateful opera Götterdämmerung. As opera fans will remember, when the singing stops the world of Valhalla comes to an abrupt end, as Brünnhilde throws herself on a pre-prepared funeral pyre and in so doing initiates the final destruction the known world. Although the interpretation that this was some sort of "Freudian slip" for what the IMF boss actually fears could happen - namely the Greek Heracles might finally abandons his labours and descend into the nether world of Hades - is plausible and available, I prefer to think it was in fact a match of American football she had in mind. At least that way I sleep better.

Greek Data Updates

Edward Hugh is only able to update this blog from time to time, but he does run a lively Twitter account with plenty of Greece related comment. He also maintains a collection of constantly updated Greece data charts with short updates on a Storify dedicated page Is Greece's Economic Recovery Now in Ruins?

Sunday, November 25, 2012

Sunday, June 17, 2012

On The Brink Of What?

This weekend I have been thinking quite a lot about what the world is gonna look like on Monday, and have come to the conclusion that it won't be that different from the way it was last Friday. The big news surprise of the weekend was in fact Greece related - since the national football team qualified for the quarter finals of the Eurocopa, beating the Russia by a resounding 1-0.

Oh yes, they also had elections in Greece, didn't they?

The most likely outcome, as far as I can see at the time of writing, is a neck and neck finish between the far left Syriza and the centre right New Democracy, with the key to the resolution of the outcome lying in the fact that whichever party comes first gets a bonus of an additional 50 seats. This will mean that if New Democracy do win, as it seems they have, they will probably be able to negotiate a deal with the other smaller parties (PASOK, for example) around some sort of face saving formula which will enable a government to be formed and a deal struck with Berlin.

On the other hand, if Syriza were to finally win no one has a clue what will happen. The party doesn't want to leave the Euro, but does want to reject the memorandum. The only problem is that the only parties Syriza could form a government with would most likely want out of the Euro too. So Syriza winning by a short head would seem to imply more elections, or... or.... some sort of pact. I vote for the latter.

I say this since I think even if Syriza were by some quirk now to win some sort of government or other would still be formed, even if it needs the military to rustle sabres in the background just to get everyone to concentrate on the issues in hand. In the game of brinksmanship which will now be played, Syriza can blackmail Berlin with the threat of instability and disorderly exit (even in opposition), while Berlin can dangle money, lot's of it I imagine, before their eyes, if only they agree to help form a government. The track record says that politicians normally, when faced with a serious punch up or going for the money will normally go for the money.

Naturally, the money I am talking here about involves EU funds, not men in black suits carrying suitcases, although if the recent 270 million fine accepted by Siemens for bribing Greek officials to obtain lucrative telecommunication contracts is anything to go by, we shouldn't rule the other possibility out entirely.

Actually Angela Merkel has already hinted at this sort of solution. "This is why it is so important that, in the Greek election tomorrow ... a result emerges in which those who form a government in future tell us, yes, we want to keep to the agreements," she told a meeting of party faithful in Darmstadt this weekend, "This is the basis on which Europe can prosper."

What the forthcoming Greek government needs to do, then, is say loudly and clearly in public that it will stick to the memorandum. Say in public mind you, not necessarily follow the statement through in practice. The phrase being asked for certainly isn't an Austinian performative, equivalent to saying "I do" in a wedding. In this case uttering the phrase does not constitute implementation. Another example of something which also does not constitute what the British philosopher JL Austin would have termed a performative would be the expression “I promise to pay the bearer on demand the sum of …” which appears on the back of UK bank notes, and is evidently not a promise, or even a lick. It is simply just another way of spilling ink.

So then, with the protocols safely out of the way, the real deal can be done. Francois Hollande is already talking about an EU growth programme of around 120 billion Euros. And the Financial Times has revealed this weekend that, "European officials are preparing to dangle a package of incentives in front of a new Greek government to convince it to stick to the country’s current bailout deal after Sunday’s high-stakes elections. The package would include further reductions in interest rates and extended repayment periods for bailout loans, as well as EU money to spur investments in Greek public works programmes through the European Investment Bank".

Naturally, and even in the best of cases, the future government of Greece will be weak, and the economic situation dire. So the agreement to be reached will only be a band aid, one which one hopes will hold until the bigger issues are faced up to over the summer. All that has been avoided this weekend is a disorderly rupture in Greece's relations with the EU and the IMF, and as I argued here, this outcome was never really very likely.

So Greece in the short term will be staying in the Euro, although I am not sure whether a majority of observers will necessarily regard this as good news, since clearly it only postpones some sort of day of reckoning or other.

Sigh Of Relief In Berlin

One venue where people will be unequivocally happy with the outcome is - although some may find this surprising - inside policy circles in Berlin. The reason for this is evident. Germany itself is at greater risk of fall out from the Greek election than even Greece itself is. Personally I think the upward trickle in German Bund yields we have been seeing over the last week or so is pretty significant. It is almost as if the market is beginning to prepare for a two stage scenario. The first stage would be Greek non exit. Then in a second stage, the EU would not be moving ahead of the curve fast enough, and the common curreny could disintegrate. Germany, as the creditor country who would not be paid, would be one of the biggest losers.

More interesting perhaps than 10 year Spanish yields hovering around 7% is the fact that German yields have also started rising, as have German CDS and the volume of German CDS being traded.

My interpretation of this is as follows. This situation can end in either of two ways. The Euro can disintegrate, or full political union can be put in place. In either case Germany's debt burden will increase. In addition the country is export dependent, and will be negatively effected by any event which damages the other Euro economies. Robin Wrigglesworth put it like this in the Financial Times.

Estimates of just how much the Troika are on the hook for should Greece default vary, but a common number is somewhere in the 200 billion euro range. Of course, some of this would eventually be recoverable, one day, and assuming Greece were able to pay, but in the meantime (given the super senior status of the IMF participation) it is highly likely that governments and taxpayers in the other Euro Area countries would need to cover the shortfall, and this, to put it mildly, is unlikely to be popular with voters. Yet another reason for "fudge and muddle through".

There are three main sources of Troika exposure to Greece, bailout loans, sovereign bonds owned by the ECB, and liquidity provided to the Greek central bank thorugh the Eurosystem via what is known as Target2. According to estimates by Commerzbank analyst Christoph Weil, between loans and bond purchases Greece owes a total of €194bn, which breaks down into €22bn owed to the IMF, €53bn to Euro Area countries, €74bn to the EFSF and €45bn to the ECB. On top of this there are Target2 liabilities of the Greek central bank vis-à-vis the ECB - and indirectly to the German banks - to the tune of €104bn.

As long as the music is playing, you’ve got to get up and dance

It was in fact former Citigroup chief Charles Prince who used this expression to characterise why, in a highly leveraged bailout (sorry, buyout) market fund managers continued to play the game, but it could equally well describe the "in for a penny in for every shilling I've got" situation German policymakers now find themselves in.

One of the silliest ideas introduced into the present Euro debate is the idea that Germany has always been a reluctant party to the common currency, and that the monetary union has acted to the country's disadvantage. Lombard’s Chief Economist Alexander Dumas tells us, for example, that ‘what you’re actually dealing with here... is a German population which has had a rotten deal – and that’s why they’re all so angry’.

Dumas's view is interesting since it highlights two popular misconceptions. The first of these is that Germany has been a long suffering victim of the spendthrift policy of its Euro Area partners, and the second is that German household consumption is so weak due to a domestic policy of wage compression. Now if we take the former argument, in fact the German economy entered the common currency in very poor shape, on the back of mid 1990s credit and construction boom, and was forced to make a substantial transition at the end from being a consumer-credit- driven economy running a small current account deficit to being an export driven one, pushed forward on the back of a large current account surplus.

If you look at the above chart, it would seem hard to argue that Germany has had a really hard time of it after joining the Euro. Just think about it. Who was buying all those German exports which are reflected in those massive current account surpluses.

This point seems so obvious it is hard to believe some people are still capable of ignoring it. It is not as if there wasn't a lot of material around pointing to this pretty evident truth. A good example of this work are the two recent and highly stimulating essays by Citi economists, Nathan Sheets and Robert Sockin, who convincingly argue that German trade performance since the start of monetary union has been significantly boosted by having a currency which was valued significantly below the valuation it would have been subjected to had the country still been using the Deutsche Mark. As a result of this systematic undervaluation Germany’s external surpluses widened significantly, led by rapid export growth.

Sheets and Sockin use a simple econometric procedure to estimate that that European monetary union, coupled with the country’s extraordinary wage restraint, has resulted in a real effective exchange rate for Germany that is currently 15 to 20 percent lower than the one which would have prevailed if Germany had had its own floating currency. And naturally the weaker real exchange rate has provided a significant windfall for Germany’s export sector. They thus find that the lower German real exchange rate has lifted the country’s nominal trade surplus by roughly 4 percent of GDP (or €100 billion) annually and the real trade surplus by about 3 percent of GDP annually. In addition, since the outbreak of the Greek crisis, Euro weakness has meant that German exports have been in an almost uniquely privileged position to benefit from strengthening global demand in the emerging market economies.

The comparison with Japan is significant in this case, since as of December 2011, Japanese exports were still running at 8% below their pre-crisis high point, while German exports were about 7% above their pre-crisis high. Since the global financial crisis German exports to China have risen most strongly, while Japanese exports to China have virtually stagnated. What could be the explanation for this strange phenomenon, since evidently Japan has efficiently produced technologically-advanced products to sell? Well, the relative values of the two currencies the countries use might offer us some part of the explanation. From the start of 2007 to mid 2008, the Japanese yen was trading in the range of 0.06 – 0.065 to the Euro. At the start of 2012 it was trading at all time record levels of just over 0.1 to the Euro – that is the yen rose versus the Euro by over 60% in just three and a half years. What German policy makers might with good reason worry is that should their country go back to the Deutsche Mark a similar fate might well await them.

Naturally in June 2008 Japan’s currency was significantly under-valued, due to its habitual use as the “carry” funding currency of preference, while Germany’s currency is currently significantly under-valued (due to the impact of the sovereign debt crisis). In July 2008 Japan’s currency valuation spiked dramatically – rising by around 30% in 3 months – as the global financial crisis took its toll and the carry trade unwound. Since that time Japan’s currency has risen steadily (as has, for example the Swiss Franc) due to the country’s safe haven status. Naturally such a state of affairs only serves to exacerbate the country’s long running deflation problem.

Taking everything into account, surely it would not be unreasonable to suggest that a Euro unwind would lead any new German currency to surge dramatically in the aftermath just as the Japanese one did in 2008, and then continue its upward path for safe haven reasons. The key point is that in the age of the global financial accelerator currency movements have a strong non-linear component.

Gazing Into The Tea Leaves

I suspect events will pan out as follows. The Greek elections will give markets a mildly positive surprise, since the country will not immediately exit the Euro, nor will European money be cut off (the IMF is another matter). In fact, as I suggest above, more money may be sent to Greece than expected via EU structural funds, or the EU investment bank.

In the meantime measures will be put in place in the direction of a European banking system and closer fiscal union. But the pace will be slow, painfully slow, and much slower than markets need to see to be convinced that real changes are coming.

So German bond yields and CDS can continue to rise, and this will produce political strains in Germany. It is these tensions inside Germany that can become the undoing of the Euro, since if political pressures cause leaders to put a break on the integration process market pressures could become too great to withstand.

Thus the reason for this sudden rush to keep the Greeks happy is evident. Germany has done its sums, and found that it is at even greater risk of getting hit by fall-out from the Greek election than Greece itself is. The thing is the Germans have now cunningly boxed themselves into a corner, and whichever way things go their position can only become worse.

I think German policy from this point on will be increasingly dictated by a belated attempt to avoid just this sort of outcome, and that we will see evidence of this over the next couple of weeks. Far from being a threat, Francoise Hollande might even help get Merkel off the hook. On the other hand, Fernando Santos, the Portuguese coach who trains Greek national side, reportedly told the press his players' victory was more inspired by Greek history than by Angela Merkel. Well if I remember my Thucydides aright, most Greek cities fell to their opponents not in pitched battle, but via "informal negotiations" held somewhere close to an unguarded side gate. Talks to form a new government will start tomorrow.

This post first appeared on my Roubini Global Economonitor Blog "Don't Shoot The Messenger".

Oh yes, they also had elections in Greece, didn't they?

The most likely outcome, as far as I can see at the time of writing, is a neck and neck finish between the far left Syriza and the centre right New Democracy, with the key to the resolution of the outcome lying in the fact that whichever party comes first gets a bonus of an additional 50 seats. This will mean that if New Democracy do win, as it seems they have, they will probably be able to negotiate a deal with the other smaller parties (PASOK, for example) around some sort of face saving formula which will enable a government to be formed and a deal struck with Berlin.

On the other hand, if Syriza were to finally win no one has a clue what will happen. The party doesn't want to leave the Euro, but does want to reject the memorandum. The only problem is that the only parties Syriza could form a government with would most likely want out of the Euro too. So Syriza winning by a short head would seem to imply more elections, or... or.... some sort of pact. I vote for the latter.

I say this since I think even if Syriza were by some quirk now to win some sort of government or other would still be formed, even if it needs the military to rustle sabres in the background just to get everyone to concentrate on the issues in hand. In the game of brinksmanship which will now be played, Syriza can blackmail Berlin with the threat of instability and disorderly exit (even in opposition), while Berlin can dangle money, lot's of it I imagine, before their eyes, if only they agree to help form a government. The track record says that politicians normally, when faced with a serious punch up or going for the money will normally go for the money.

Naturally, the money I am talking here about involves EU funds, not men in black suits carrying suitcases, although if the recent 270 million fine accepted by Siemens for bribing Greek officials to obtain lucrative telecommunication contracts is anything to go by, we shouldn't rule the other possibility out entirely.

Actually Angela Merkel has already hinted at this sort of solution. "This is why it is so important that, in the Greek election tomorrow ... a result emerges in which those who form a government in future tell us, yes, we want to keep to the agreements," she told a meeting of party faithful in Darmstadt this weekend, "This is the basis on which Europe can prosper."

What the forthcoming Greek government needs to do, then, is say loudly and clearly in public that it will stick to the memorandum. Say in public mind you, not necessarily follow the statement through in practice. The phrase being asked for certainly isn't an Austinian performative, equivalent to saying "I do" in a wedding. In this case uttering the phrase does not constitute implementation. Another example of something which also does not constitute what the British philosopher JL Austin would have termed a performative would be the expression “I promise to pay the bearer on demand the sum of …” which appears on the back of UK bank notes, and is evidently not a promise, or even a lick. It is simply just another way of spilling ink.

So then, with the protocols safely out of the way, the real deal can be done. Francois Hollande is already talking about an EU growth programme of around 120 billion Euros. And the Financial Times has revealed this weekend that, "European officials are preparing to dangle a package of incentives in front of a new Greek government to convince it to stick to the country’s current bailout deal after Sunday’s high-stakes elections. The package would include further reductions in interest rates and extended repayment periods for bailout loans, as well as EU money to spur investments in Greek public works programmes through the European Investment Bank".

Naturally, and even in the best of cases, the future government of Greece will be weak, and the economic situation dire. So the agreement to be reached will only be a band aid, one which one hopes will hold until the bigger issues are faced up to over the summer. All that has been avoided this weekend is a disorderly rupture in Greece's relations with the EU and the IMF, and as I argued here, this outcome was never really very likely.

So Greece in the short term will be staying in the Euro, although I am not sure whether a majority of observers will necessarily regard this as good news, since clearly it only postpones some sort of day of reckoning or other.

Sigh Of Relief In Berlin

One venue where people will be unequivocally happy with the outcome is - although some may find this surprising - inside policy circles in Berlin. The reason for this is evident. Germany itself is at greater risk of fall out from the Greek election than even Greece itself is. Personally I think the upward trickle in German Bund yields we have been seeing over the last week or so is pretty significant. It is almost as if the market is beginning to prepare for a two stage scenario. The first stage would be Greek non exit. Then in a second stage, the EU would not be moving ahead of the curve fast enough, and the common curreny could disintegrate. Germany, as the creditor country who would not be paid, would be one of the biggest losers.

More interesting perhaps than 10 year Spanish yields hovering around 7% is the fact that German yields have also started rising, as have German CDS and the volume of German CDS being traded.

My interpretation of this is as follows. This situation can end in either of two ways. The Euro can disintegrate, or full political union can be put in place. In either case Germany's debt burden will increase. In addition the country is export dependent, and will be negatively effected by any event which damages the other Euro economies. Robin Wrigglesworth put it like this in the Financial Times.

Analysts said this was a worrying development, which indicated investors could be starting to prepare for two “tail-risks” – a break-up of the common currency bloc or moves towards fiscal union.“If we see a trend of periphery bonds, Bunds and the euro start to sell off simultaneously we’d move from concern to alarm,” said David Lloyd, head of institutional portfolio management at M&G Investments.

Estimates of just how much the Troika are on the hook for should Greece default vary, but a common number is somewhere in the 200 billion euro range. Of course, some of this would eventually be recoverable, one day, and assuming Greece were able to pay, but in the meantime (given the super senior status of the IMF participation) it is highly likely that governments and taxpayers in the other Euro Area countries would need to cover the shortfall, and this, to put it mildly, is unlikely to be popular with voters. Yet another reason for "fudge and muddle through".

There are three main sources of Troika exposure to Greece, bailout loans, sovereign bonds owned by the ECB, and liquidity provided to the Greek central bank thorugh the Eurosystem via what is known as Target2. According to estimates by Commerzbank analyst Christoph Weil, between loans and bond purchases Greece owes a total of €194bn, which breaks down into €22bn owed to the IMF, €53bn to Euro Area countries, €74bn to the EFSF and €45bn to the ECB. On top of this there are Target2 liabilities of the Greek central bank vis-à-vis the ECB - and indirectly to the German banks - to the tune of €104bn.

As long as the music is playing, you’ve got to get up and dance

It was in fact former Citigroup chief Charles Prince who used this expression to characterise why, in a highly leveraged bailout (sorry, buyout) market fund managers continued to play the game, but it could equally well describe the "in for a penny in for every shilling I've got" situation German policymakers now find themselves in.

One of the silliest ideas introduced into the present Euro debate is the idea that Germany has always been a reluctant party to the common currency, and that the monetary union has acted to the country's disadvantage. Lombard’s Chief Economist Alexander Dumas tells us, for example, that ‘what you’re actually dealing with here... is a German population which has had a rotten deal – and that’s why they’re all so angry’.

Dumas's view is interesting since it highlights two popular misconceptions. The first of these is that Germany has been a long suffering victim of the spendthrift policy of its Euro Area partners, and the second is that German household consumption is so weak due to a domestic policy of wage compression. Now if we take the former argument, in fact the German economy entered the common currency in very poor shape, on the back of mid 1990s credit and construction boom, and was forced to make a substantial transition at the end from being a consumer-credit- driven economy running a small current account deficit to being an export driven one, pushed forward on the back of a large current account surplus.

If you look at the above chart, it would seem hard to argue that Germany has had a really hard time of it after joining the Euro. Just think about it. Who was buying all those German exports which are reflected in those massive current account surpluses.

This point seems so obvious it is hard to believe some people are still capable of ignoring it. It is not as if there wasn't a lot of material around pointing to this pretty evident truth. A good example of this work are the two recent and highly stimulating essays by Citi economists, Nathan Sheets and Robert Sockin, who convincingly argue that German trade performance since the start of monetary union has been significantly boosted by having a currency which was valued significantly below the valuation it would have been subjected to had the country still been using the Deutsche Mark. As a result of this systematic undervaluation Germany’s external surpluses widened significantly, led by rapid export growth.

Sheets and Sockin use a simple econometric procedure to estimate that that European monetary union, coupled with the country’s extraordinary wage restraint, has resulted in a real effective exchange rate for Germany that is currently 15 to 20 percent lower than the one which would have prevailed if Germany had had its own floating currency. And naturally the weaker real exchange rate has provided a significant windfall for Germany’s export sector. They thus find that the lower German real exchange rate has lifted the country’s nominal trade surplus by roughly 4 percent of GDP (or €100 billion) annually and the real trade surplus by about 3 percent of GDP annually. In addition, since the outbreak of the Greek crisis, Euro weakness has meant that German exports have been in an almost uniquely privileged position to benefit from strengthening global demand in the emerging market economies.

The comparison with Japan is significant in this case, since as of December 2011, Japanese exports were still running at 8% below their pre-crisis high point, while German exports were about 7% above their pre-crisis high. Since the global financial crisis German exports to China have risen most strongly, while Japanese exports to China have virtually stagnated. What could be the explanation for this strange phenomenon, since evidently Japan has efficiently produced technologically-advanced products to sell? Well, the relative values of the two currencies the countries use might offer us some part of the explanation. From the start of 2007 to mid 2008, the Japanese yen was trading in the range of 0.06 – 0.065 to the Euro. At the start of 2012 it was trading at all time record levels of just over 0.1 to the Euro – that is the yen rose versus the Euro by over 60% in just three and a half years. What German policy makers might with good reason worry is that should their country go back to the Deutsche Mark a similar fate might well await them.

Naturally in June 2008 Japan’s currency was significantly under-valued, due to its habitual use as the “carry” funding currency of preference, while Germany’s currency is currently significantly under-valued (due to the impact of the sovereign debt crisis). In July 2008 Japan’s currency valuation spiked dramatically – rising by around 30% in 3 months – as the global financial crisis took its toll and the carry trade unwound. Since that time Japan’s currency has risen steadily (as has, for example the Swiss Franc) due to the country’s safe haven status. Naturally such a state of affairs only serves to exacerbate the country’s long running deflation problem.

Taking everything into account, surely it would not be unreasonable to suggest that a Euro unwind would lead any new German currency to surge dramatically in the aftermath just as the Japanese one did in 2008, and then continue its upward path for safe haven reasons. The key point is that in the age of the global financial accelerator currency movements have a strong non-linear component.

Gazing Into The Tea Leaves

I suspect events will pan out as follows. The Greek elections will give markets a mildly positive surprise, since the country will not immediately exit the Euro, nor will European money be cut off (the IMF is another matter). In fact, as I suggest above, more money may be sent to Greece than expected via EU structural funds, or the EU investment bank.

In the meantime measures will be put in place in the direction of a European banking system and closer fiscal union. But the pace will be slow, painfully slow, and much slower than markets need to see to be convinced that real changes are coming.

So German bond yields and CDS can continue to rise, and this will produce political strains in Germany. It is these tensions inside Germany that can become the undoing of the Euro, since if political pressures cause leaders to put a break on the integration process market pressures could become too great to withstand.

Thus the reason for this sudden rush to keep the Greeks happy is evident. Germany has done its sums, and found that it is at even greater risk of getting hit by fall-out from the Greek election than Greece itself is. The thing is the Germans have now cunningly boxed themselves into a corner, and whichever way things go their position can only become worse.

I think German policy from this point on will be increasingly dictated by a belated attempt to avoid just this sort of outcome, and that we will see evidence of this over the next couple of weeks. Far from being a threat, Francoise Hollande might even help get Merkel off the hook. On the other hand, Fernando Santos, the Portuguese coach who trains Greek national side, reportedly told the press his players' victory was more inspired by Greek history than by Angela Merkel. Well if I remember my Thucydides aright, most Greek cities fell to their opponents not in pitched battle, but via "informal negotiations" held somewhere close to an unguarded side gate. Talks to form a new government will start tomorrow.

This post first appeared on my Roubini Global Economonitor Blog "Don't Shoot The Messenger".

Thursday, May 31, 2012

Grexit? Spexit? Let's Call the Whole Thing Off

One thing we've learned as the euro crisis has unfolded is that the enthusiasm of experts in London and New York for offering advice to the struggling countries on Europe's periphery is matched only by their passion for awkward neologisms. The world was just getting used to "Grexit" (Get it? A Greek exit from the euro!) when "Spexit" began to rear its ugly head in the financial press.

Naturally, the events of recent days have brought Spain back to the forefront of the debt crisis, generating insecurity about the reliability of the official fiscal deficit numbers, the validity of central bank statistics, and new numbers showing capital flight reaching alarming levels. Only this week, Spain announced that the central bank governor, Miguel Angel Fernandez Ordoñez, will be leaving early as part of a government effort to restore its credibility. Some are now anticipating that Spain's exit from the eurozone will come before Greece's departure.

I would hope that those clamoring for these countries to go their own way are at least better intentioned than they are informed, since normally they exhibit a singular lack of understanding about how political systems in southern and eastern Europe actually work.

It is now essentially conventional wisdom in the British and American press that Greece needs to return to the drachma. British journalists are even racing to hunt down the London printing works that have supposedly been given the contract to print New Drachmas, the putative local replacement for the euro. The only snag is, according to all opinion polls, the Greeks themselves are not happy with the euro but have no interest in dropping it. (Perhaps the perfect Solomonic solution here would be to have the New Drachma introduced as a non-convertible currency for use only within Fleet Street bars and the boundaries of the City of London.)

The Greeks, naturally, are tired of austerity, and of a stupid EU/IMF bailout plan that has only served to totally collapse their economy, explode their debt, and destroy what semblance of external reputation Greek companies had. The Greeks are tired of austerity in the way many in the United States have tired of fiscal stimulus in the run-up to the next presidential election. But no one would suggest that this weariness is an indication that Americans want to drop the dollar.

As an economist, I have always argued that the common currency was a mistake. I am a "euro" skeptic, but not a "Euroskeptic," and I think it important that people outside Europe understand that this distinction exists. There is no doubt that the euro, like Dr. Stangelove's doomsday machine, is an infernal device destined to blow up one day, but also so designed that any attempt to dismantle it simply detonates the bomb. This is why, tired as they may be, those who live on Europe's southern fringe have little appetite for leaving or taking part in yet another experimental new currency order. Better put, they have little appetite for leaving in a disorderly fashion. And disorderly the leaving would have to be, since if core Europe has little appetite for assuming the cost of keeping the eurozone together, it will surely have even less for paying the much larger bill associated with exit and default.

The media's increasing scrutiny of Spain is similarly misguided. Despite the many voices now recommending a "Spexit," few are really knowledgeable about daily life here in Spain, and even fewer are actually to be found inside the country.

The story of how Spain got to this point is well-known. There was a huge property bubble (could we say the mother of all of them?), a decade of above-EU-average inflation, a massive loss of competitiveness, a huge current account deficit, and an unprecedented stock of external debt. All of this now needs to be unwound, but here's the rub: It is very easy to structurally distort an economy within the framework of a currency union, but very difficult to correct the distortions once generated. This is why so many rightly say that in Spain it is all pain as far ahead as the eye can see. It is not that the Spanish people like this, but just that they don't see any clear and better alternative. And indeed, while only 37 percent of Spaniards believe having the euro is a good thing, according to a recent Pew poll, 60 percent favor keeping it.

The departure of Ordoñez, the central banker, may seem more dramatic from the outside than it does from within. Certainly Mafo, as he is called, bears a heavy responsibility for Spain's continual failure to get a grip on the rot in its financial system, and for the disastrous decision to allow the insolvent Bankia conglomerate to go to IPO last year, losing shareholders more than $2 billion and badly damaging the credibility of the country's banking sector. But his is only one name on what should be a very long list of putative villains, including members of the present government, the previous one, the EU Commission, the European Central Bank (ECB), and last but not least the IMF, where ex-Bank of Spain deputy director Jose Viñals has been busying himself for months writing reports suggesting the condition of Spain's banks was not all that bad.

The real question is what happens next. Spain, like the euro itself, is both too big to rescue and too big to fail. Spain's banks need capital from the government, but the government itself can't finance them. Foreign investors are leaving in droves, but no matter how many liquidity offers they get from the ECB, the country's banks simply can't buy all the debt. So the country needs European (read: German) money. The problem is that if this takes the form of an injection of bank equity, then Germany could end up all but owning Spain's banks, which would expose German taxpayers to considerable potential losses should the situation deteriorate further. At this point Berlin could firmly put its foot down, and we will have another impasse.

At the end of June, Europe will face what many consider to be a perfect storm: results of the Greek elections and details of the new, independent, Spanish bank valuations, which are sure to find that significantly more money will be needed for recapitalization. This will undoubtedly be a make-or-break moment in the ongoing debt crisis, and, if things were to spiral hopelessly out of control, a Spexit could become a real possibility. My advice to all those external well-wishers would be: Be careful what you ask for, since you might not like what you finally get.

This article originally appeared in the magazine Foreign Policy.

Naturally, the events of recent days have brought Spain back to the forefront of the debt crisis, generating insecurity about the reliability of the official fiscal deficit numbers, the validity of central bank statistics, and new numbers showing capital flight reaching alarming levels. Only this week, Spain announced that the central bank governor, Miguel Angel Fernandez Ordoñez, will be leaving early as part of a government effort to restore its credibility. Some are now anticipating that Spain's exit from the eurozone will come before Greece's departure.

I would hope that those clamoring for these countries to go their own way are at least better intentioned than they are informed, since normally they exhibit a singular lack of understanding about how political systems in southern and eastern Europe actually work.

It is now essentially conventional wisdom in the British and American press that Greece needs to return to the drachma. British journalists are even racing to hunt down the London printing works that have supposedly been given the contract to print New Drachmas, the putative local replacement for the euro. The only snag is, according to all opinion polls, the Greeks themselves are not happy with the euro but have no interest in dropping it. (Perhaps the perfect Solomonic solution here would be to have the New Drachma introduced as a non-convertible currency for use only within Fleet Street bars and the boundaries of the City of London.)

The Greeks, naturally, are tired of austerity, and of a stupid EU/IMF bailout plan that has only served to totally collapse their economy, explode their debt, and destroy what semblance of external reputation Greek companies had. The Greeks are tired of austerity in the way many in the United States have tired of fiscal stimulus in the run-up to the next presidential election. But no one would suggest that this weariness is an indication that Americans want to drop the dollar.

As an economist, I have always argued that the common currency was a mistake. I am a "euro" skeptic, but not a "Euroskeptic," and I think it important that people outside Europe understand that this distinction exists. There is no doubt that the euro, like Dr. Stangelove's doomsday machine, is an infernal device destined to blow up one day, but also so designed that any attempt to dismantle it simply detonates the bomb. This is why, tired as they may be, those who live on Europe's southern fringe have little appetite for leaving or taking part in yet another experimental new currency order. Better put, they have little appetite for leaving in a disorderly fashion. And disorderly the leaving would have to be, since if core Europe has little appetite for assuming the cost of keeping the eurozone together, it will surely have even less for paying the much larger bill associated with exit and default.

The media's increasing scrutiny of Spain is similarly misguided. Despite the many voices now recommending a "Spexit," few are really knowledgeable about daily life here in Spain, and even fewer are actually to be found inside the country.

The story of how Spain got to this point is well-known. There was a huge property bubble (could we say the mother of all of them?), a decade of above-EU-average inflation, a massive loss of competitiveness, a huge current account deficit, and an unprecedented stock of external debt. All of this now needs to be unwound, but here's the rub: It is very easy to structurally distort an economy within the framework of a currency union, but very difficult to correct the distortions once generated. This is why so many rightly say that in Spain it is all pain as far ahead as the eye can see. It is not that the Spanish people like this, but just that they don't see any clear and better alternative. And indeed, while only 37 percent of Spaniards believe having the euro is a good thing, according to a recent Pew poll, 60 percent favor keeping it.

The departure of Ordoñez, the central banker, may seem more dramatic from the outside than it does from within. Certainly Mafo, as he is called, bears a heavy responsibility for Spain's continual failure to get a grip on the rot in its financial system, and for the disastrous decision to allow the insolvent Bankia conglomerate to go to IPO last year, losing shareholders more than $2 billion and badly damaging the credibility of the country's banking sector. But his is only one name on what should be a very long list of putative villains, including members of the present government, the previous one, the EU Commission, the European Central Bank (ECB), and last but not least the IMF, where ex-Bank of Spain deputy director Jose Viñals has been busying himself for months writing reports suggesting the condition of Spain's banks was not all that bad.

The real question is what happens next. Spain, like the euro itself, is both too big to rescue and too big to fail. Spain's banks need capital from the government, but the government itself can't finance them. Foreign investors are leaving in droves, but no matter how many liquidity offers they get from the ECB, the country's banks simply can't buy all the debt. So the country needs European (read: German) money. The problem is that if this takes the form of an injection of bank equity, then Germany could end up all but owning Spain's banks, which would expose German taxpayers to considerable potential losses should the situation deteriorate further. At this point Berlin could firmly put its foot down, and we will have another impasse.

At the end of June, Europe will face what many consider to be a perfect storm: results of the Greek elections and details of the new, independent, Spanish bank valuations, which are sure to find that significantly more money will be needed for recapitalization. This will undoubtedly be a make-or-break moment in the ongoing debt crisis, and, if things were to spiral hopelessly out of control, a Spexit could become a real possibility. My advice to all those external well-wishers would be: Be careful what you ask for, since you might not like what you finally get.

This article originally appeared in the magazine Foreign Policy.

Sunday, May 20, 2012

Can This Really Be Europe We Are Talking About?

In recent days I have been think a lot, and reading a lot, about the implications of Greece's recent election results.

At the end of the day the only difference this whole process makes to the ultimate outcome may turn out to be one of timing. If Alexis Tsipras of the anti bailout, anti Troika, party Syriza won and started to form a government then the second bailout money would undoubtedly be immediately stopped. On the other hand if the centre right New Democracy wins and is able to form a government, as the latest polls tend to suggest, then the country would quite possibly try to conform to the bailout conditions, but in trying it would almost certainly fail, and then the money would be stopped. Before the last election results, it will be remembered, this was the main scenario prevailing.

Indeed reports coming out of Greece suggest that the end point may be reached more quickly than even previously thought, since the main impact of recent events is that the reform process in the country has been put on hold, meaning that slippage on implementation by the time we get to June will be even greater than it otherwise would have been.

Grexit Ahoy?

Either way, it is what happens next that leads to all the speculation. The international press has been full all though the last week of statements from one European leader after another suggesting that Greece may need to exit the Euro. The latest to add his name has been the Slovenian Finance Minister Janez Sustersic, but before him there has been a long list of leading personalities including EU Trade Commissioner Karel De Gucht who told the press that the European Commission and the European Central Bank were working on scenarios in case the country had to leave. European Central Bank President Mario Draghi even entered what are unchartered waters for the institution he leads and acknowledged that Greece could end up leaving the euro area, although if it did he stressed the decision would not be taken by the ECB.

In The Name Of God Go!

While Mario Draghi may have been being strongly diplomatic, ECB Executive Board member Joerg Asmussen was far less so, and told Handelsblatt newspaper on May 8 that if Greece wanted to remain in the euro, it had “no alternative” than to stick to its agreed consolidation program. The influential German magazine Der Spiegel went even further. Under the header "Time To Admit Defeat, Greece Can No Longer Delay Eurozone Exit", the magazine said what had previously been the unsayable: "After Greek voters rejected austerity in last week's election, plunging the country into a political crisis, Europe has been searching for a Plan B for Greece. It's time to admit that the EU/IMF rescue plan has failed. Greece's best hopes now lie in a return to the drachma".

The inconvenient problem is that things don't look that way in Athens, where even the anti-establishment Alexis Tsipras is only talking about ending austerity, and renegotiating agreements, at the same time making it abundantly clear he has every intention of staying in the Euro. The fact of the matter is that there are very few Greeks who actually want to leave, and it is hard to believe that those arguing the country's best hopes are either this, or that, really have the true interest of the country and its citizens at heart. The FT's John Dizard sums the situation up thus: "There has been an astonishing quantity of nonsense written in the past couple of weeks about the prospect of “Grexit”, or Greece's exit from the Euro".

One of the key additional reasons that much of what has been written has been "nonesense" is that few have stopped to think about what the real cost to core Europe would be of a Greek default (see below). But then, they never have been that strong on financial arithmetic in Berlin.

So whether push comes to shove at the next review, or the one after, no one is really clear what gets to happen next, and this is part of the reason why there is so much nervousness in the markets at this point. Many assume that after the tap is turned off the country would quickly run out of money, but there are a variety of devices that the Greek government, in conjunction with the central bank, could use to keep the cash flowing. Some think the country would follow the Argentinian example, and start issuing internally valid scrip money, like the ill fated Patacos or Lecops. But Argentina was not in a currency union with the United States, the country had simply unilaterally decided to peg the Peso to the Dollar. Argentina could not print Dollars, but Greece can - in a variety of ways, the best known being Emergency Liquidity Assistance (ELA) - generate its own Euros, and enable the government to, for example, sell T Bills to Greek banks in order to pay pensioners, civil servants, government suppliers etc.

Then, so the story goes, the ECB would have no alternative but to shut Greece off from the Eurosystem. To some this might seem like an act of war. This wouldn't be Greece leaving, this would be Greece being turfed out. Yet this secnario was just what the markets got a scare about this week, when the ECB announced it was cutting off liquidity to four Greek banks. Ominous echoes of Mr Draghi's words about the ECB protecting the integrity of its balance sheet. As it turns out, the move was less sinister than it seemed, since part of the problem was that the Greek government bureaucracy was inefficiently holding up the recapitalisation of some Greek banks, a move which had left them with negative capital, and the ECB was understandably reluctant to continue accepting collateral from them under these circumstances. Part of the problem here is that very few people, as FT Alphaville's Joseph Cotterill points out, really understand what ELA is, but this is not really surprising as the ECB itself has hardly been forthcoming with information and details on how ELA is being used.

In any event, continuing the supply of liquidity to Greek banks, and including or excluding the Greek central bank in/from the Eurosystem are likely to become key issues as we proceed. As Mr Draghi argues the issue is a political one, not a banking one, which means the bank is going to be very constrained if it wants to act as a bank without the relevant authority. This is the kind of hot potato which is likely to be passed from one desk to the next (Yes, Mr President, but...) with no one really being willing to go down in history as the person who might have torn Europe apart, which leads us to the conclusion that the "muddle through and fudge" stage might last quite a bit longer than many are expecting.

If I Owe You 10 billion I have A Problem, But If I Owe You 300 billion..........

As John Paul Getty famously said, "If you owe the bank $100 that's your problem. If you owe the bank $100 million, that's the bank's problem". Never a truer word was said in the Greek case, and it is the reality that Mr Tsipras and those around him have, I suspect, understood. Now I fully appreciate that the Troika are a group of people who are motivated largely by principles not by money, but when your principles could cost you, and those providing you with the money you spend, 200 billion Euros, 300 billion Euros, or whatever, then dare I suggest there is food for them to think.

Estimates of just how much the Troika are on the hook for should Greece default vary, but a common number is somewhere in the 200 billion euro range. Of course, some of this would eventually be recoverable, one day, and assuming Greece were able to pay, but in the meantime (given the super senior status of the IMF participation) it is highly likely that governments and taxpayers in the other Euro Area countries would need to cover the shortfall, and this, to put it mildly, is unlikely to be popular with voters. Yet another reason for "fudge and muddle through".

There are three main sources of Troika exposure to Greece, bailout loans, sovereign bonds owned by the ECB, and liquidity provided to the Greek central bank thorugh the Eurosystem via what is known as Target2. Now according to estimates by Commerzbank analyst Christoph Weil, between loans and bond purchases Greece owes a total of €194bn, which breaks down into €22bn owed to the IMF, €53bn to Euro Area countries, €74bn to the EFSF and €45bn to the ECB. On top of this there are Target2 liabilities of the Greek central bank vis-à-vis the ECB - and indirectly to the German banks - to the tune of €104bn.

As Christoph says in his report: "It would undoubtedly be bitter for the German government to have to tell taxpayers they would have to fork out €75bn if the debts were not repaid, but the alternative of continuing to throw good money after bad, would not make it any more popular either". Methinks he is being a bit too blasé here, since while it is surely the case that a 75 billion Euro bill for the German taxpayer would cause a furore, I'm not sure he has grasped just what a problem this would then present for continuing with further bailouts as needed with other troubled countries.

Can This Really Be Europe?

Nonetheless, despite the fact that Mr Tsipras would now appear to have Germany's leadership by the short and curlies (something Barack Obama's US advisers will surely have been spelling out to them in Camp David this weekend), it is not at all clear what turn events will take from here on in. History is, after all, often more about the unintended consequences of unexpected accidents than it is about plans.

Nevertheless, several things are clear. In the first place, the Greek economy is in unremitting decline, under the weight of the healing measures being applied by the IMF and its European partners. GDP was down by approximately 17% at the end of 2011 from its Q3 2008 high. Not as steep as the Latvian 25% fall - but then the IMF are still forecasting a further 5% decline in 2012, and without devaluation don't expect any sharp bounce back. Both reputationally and infrastructurally the country is being quite literally destroyed. The medicine has evidently been worse than the illness, and maybe it is just coincidental, but the Marshall Plan type aid which the country now obviously needs was originally applied in Europe following the destruction of WWII.

But in Greece it's going to be worse, since no one back then had the kind of ageing population problems the country is now about to face. And while the problem remains awaiting resolution, industrial output and retail sales continue in what has all the appearance of terminal decline, while unemployment - which hit 21.7% in January, second only in the EU to Spain - is still on the rise.

So something patently isn't working, and excuse me for saying it, but I find it hard to think of a leading applied macroeconomist who wasn't warning about this right from the start. But no, the creed of the the micro people and their structural reforms (which, as I keep stressing, are needed) was preferred, and we have ended up where we have ended up.

Right now there are two, and only two, options on the table as far as I can see: help Greece with an orderly exit from the Euro (and crystallise the losses in Berlin, Washington, etc), or print money at the ECB to send a monthly paycheck to all those Greek unemployed. This latter suggestion may seem ridiculous (then go for the former), but so is talk of printing to fuel inflation in Germany (go tell that old wives tale to the marines). If Greece isn't allowed to devalue, then some device must be found to subsidise Greek labour costs and encourage inbound investment - and remember, given the reputational damage inflicted on the country this is going to be hard, very hard, work.

In fact, as I jokingly suggested on my Facebook (and this is a joke, really) on one reading you could come to the conclusion that what lies behind Paul Krugman's recent tantalising play on the association between Wagner (Eurodammerung) and Coppola (Apocalypse Fairly Soon), is Ben Bernanke's idea of a helicopter drop.

Could it be that the message he was trying to subliminally sneak in to camp David this weekend was that unable to afford either Greek exit (colloquially known as Grexit) or Greek Euro Membership, the world's leaders now find themselves trapped in a Gregory Bateson-type double bind. According to Wikpedia "a double bind is an emotionally distressing dilemma in communication in which an individual (or group) receives two or more conflicting messages, in which one message negates the other. This creates a situation in which a successful response to one message results in a failed response to the other (and vice versa), so that the person will be automatically wrong regardless of response. The double bind occurs when the person cannot confront the inherent dilemma, and therefore cannot resolve it or opt out of the situation".

The only viable way to cut the gordian knot without confronting and resolving the underlying problem which at the end of the day afflicts many of the countries on Europe's periphery (devaluation and aided default) would be the organising of weekly helicopter drops of freshly printed Euros all along the beaches of southern Europe (oh, we will fight this one on the beaches, and in the chiringuitos, Mr Tsipras told a shocked group of assembled journalists) at a stroke resolving a large part of the youth unemployment problem, and generating demand for products from core Europe (after all, who would go and work in a dreary old factory when you can get the same income lying on the beach). I can just here them over at the ECB, "whohay, am I on a roll man!", as the printing presses go to work.

And to cap it all, I can just see Paul requesting to fly one of the choppers. "The surfing looks pretty good down there at the moment, Mr President". As one commentor said, you can just smell those Euros burning through the morning mist.

But of course, joking apart, Krugman does have a point. The G8 leaders are now in a ridiculous situation, one they should never have put themselves in. Apart from the cost of disorderly Greek exit, just imagine how Spanish or Italian deposit holders would react to the sight of Greek Euros being forcibly converted into New Drachma, or some such.

Then there is the Guardian's Julia Kollewe, who last week spelt out for us a number of highly unpleasant consquences which would follow, including a rush for the door by a lot of young Greeks. Kollewe indeed paints a bleak picture of Europe's future:

So I ask myself, is this Europe we are talking about here, or is this some kind of dream I am having? Is this where all those high minded ideals of a European Community have lead us, to a Greece where the young people get locked in, like in the old days of the USSR, or locked out as in the days before Schengen. Is this what the real outcome of the election of Francoise Hollande as President of France is going to mean? I hope not, since if it is it would surely split Europe right down the middle, and not just by drawing a line running from East to West.

This post first appeared on my Roubini Global Economonitor Blog "Don't Shoot The Messenger".

At the end of the day the only difference this whole process makes to the ultimate outcome may turn out to be one of timing. If Alexis Tsipras of the anti bailout, anti Troika, party Syriza won and started to form a government then the second bailout money would undoubtedly be immediately stopped. On the other hand if the centre right New Democracy wins and is able to form a government, as the latest polls tend to suggest, then the country would quite possibly try to conform to the bailout conditions, but in trying it would almost certainly fail, and then the money would be stopped. Before the last election results, it will be remembered, this was the main scenario prevailing.

Indeed reports coming out of Greece suggest that the end point may be reached more quickly than even previously thought, since the main impact of recent events is that the reform process in the country has been put on hold, meaning that slippage on implementation by the time we get to June will be even greater than it otherwise would have been.

"The only thing we are doing is waiting," said a government official who declined to be named. Another Greek official close to bailout negotiations said ministers in the outgoing cabinet have not been authorised to negotiate with Greece's lenders since the May 6 election. A senior party official said the caretaker government would not publish any decrees and all tender procedures were suspended.Looking at the above list, it is hard not to come to the conclusion that it might be in the interests of all concerned for Syriza to win the elections and force the issue. Putting together another weak government that can't implement will only lead to more fudging, and put us back where we are now in three or six months time.

Even before the May 6 election, many reforms were put on the backburner to avoid antagonising voters, officials involved in bailout talks say. These include a plan to slash spending by over 11.5 billion euros in 2013-2014, which Greece must agree by late June to meet a key bailout target.

Other measures Greece should have taken by the end of June include a plan to improve tax collection by 1.5 percent of GDP in 2013-2014, a review of social spending to identify 1 percent of GDP in savings, and a pay cut for some public sector jobs by an average of 12 percent.

One key measure is the budget deficit. Athens was broadly on track in the first quarter with a primary surplus on a cash basis of 2.3 billion euros excluding interest payments on debt, versus a 0.5 billion primary surplus in the same period in 2011.

But low value added tax collection and increased transfers to the social security system to offset weak business and employee contributions continue to be soft spots.

Another problem - which the EU and IMF will check before giving any green light on the accounts - is government arrears. Unpaid debts to third parties for over 90 days stood at 6.3 billion euros at end-March or 3.1 percent of projected GDP this year, according to economists at EFG Eurobank.

EU and IMF policymakers, exasperated by repeated delays on all reform areas over the two years of a first, 110-billion euro bailout, have warned they will not deliver any more aid under the new bailout if Athens veers off the reform track yet again.

Grexit Ahoy?

Either way, it is what happens next that leads to all the speculation. The international press has been full all though the last week of statements from one European leader after another suggesting that Greece may need to exit the Euro. The latest to add his name has been the Slovenian Finance Minister Janez Sustersic, but before him there has been a long list of leading personalities including EU Trade Commissioner Karel De Gucht who told the press that the European Commission and the European Central Bank were working on scenarios in case the country had to leave. European Central Bank President Mario Draghi even entered what are unchartered waters for the institution he leads and acknowledged that Greece could end up leaving the euro area, although if it did he stressed the decision would not be taken by the ECB.

While the bank’s “strong preference” is that Greece stays in the euro area, “the ECB will continue to comply with the mandate of keeping price stability over the medium term in line with treaty provisions and preserving the integrity of our balance sheet,” Draghi said in a speech in Frankfurt today. Since the euro’s founding treaty does not envisage a member state leaving the monetary union, “this is not a matter for the Governing Council to decide,” Draghi said.This is all a long long way from the days of "Hotel California", and the Euro as an institution where you can check in but you can't check out, and other such sentiments which typified the Trichet era, which now seems to far behind us. The decision would not be an ECB one, but what if preserving the integrity of the central bank balance sheet implied cutting of the lifeline to Greece's banking system? The decision might then be nominally Greek, but at the end of the day it would have been forced on the country by a proactive ECB.

In The Name Of God Go!

While Mario Draghi may have been being strongly diplomatic, ECB Executive Board member Joerg Asmussen was far less so, and told Handelsblatt newspaper on May 8 that if Greece wanted to remain in the euro, it had “no alternative” than to stick to its agreed consolidation program. The influential German magazine Der Spiegel went even further. Under the header "Time To Admit Defeat, Greece Can No Longer Delay Eurozone Exit", the magazine said what had previously been the unsayable: "After Greek voters rejected austerity in last week's election, plunging the country into a political crisis, Europe has been searching for a Plan B for Greece. It's time to admit that the EU/IMF rescue plan has failed. Greece's best hopes now lie in a return to the drachma".

The inconvenient problem is that things don't look that way in Athens, where even the anti-establishment Alexis Tsipras is only talking about ending austerity, and renegotiating agreements, at the same time making it abundantly clear he has every intention of staying in the Euro. The fact of the matter is that there are very few Greeks who actually want to leave, and it is hard to believe that those arguing the country's best hopes are either this, or that, really have the true interest of the country and its citizens at heart. The FT's John Dizard sums the situation up thus: "There has been an astonishing quantity of nonsense written in the past couple of weeks about the prospect of “Grexit”, or Greece's exit from the Euro".

One of the key additional reasons that much of what has been written has been "nonesense" is that few have stopped to think about what the real cost to core Europe would be of a Greek default (see below). But then, they never have been that strong on financial arithmetic in Berlin.

So whether push comes to shove at the next review, or the one after, no one is really clear what gets to happen next, and this is part of the reason why there is so much nervousness in the markets at this point. Many assume that after the tap is turned off the country would quickly run out of money, but there are a variety of devices that the Greek government, in conjunction with the central bank, could use to keep the cash flowing. Some think the country would follow the Argentinian example, and start issuing internally valid scrip money, like the ill fated Patacos or Lecops. But Argentina was not in a currency union with the United States, the country had simply unilaterally decided to peg the Peso to the Dollar. Argentina could not print Dollars, but Greece can - in a variety of ways, the best known being Emergency Liquidity Assistance (ELA) - generate its own Euros, and enable the government to, for example, sell T Bills to Greek banks in order to pay pensioners, civil servants, government suppliers etc.

Then, so the story goes, the ECB would have no alternative but to shut Greece off from the Eurosystem. To some this might seem like an act of war. This wouldn't be Greece leaving, this would be Greece being turfed out. Yet this secnario was just what the markets got a scare about this week, when the ECB announced it was cutting off liquidity to four Greek banks. Ominous echoes of Mr Draghi's words about the ECB protecting the integrity of its balance sheet. As it turns out, the move was less sinister than it seemed, since part of the problem was that the Greek government bureaucracy was inefficiently holding up the recapitalisation of some Greek banks, a move which had left them with negative capital, and the ECB was understandably reluctant to continue accepting collateral from them under these circumstances. Part of the problem here is that very few people, as FT Alphaville's Joseph Cotterill points out, really understand what ELA is, but this is not really surprising as the ECB itself has hardly been forthcoming with information and details on how ELA is being used.

In any event, continuing the supply of liquidity to Greek banks, and including or excluding the Greek central bank in/from the Eurosystem are likely to become key issues as we proceed. As Mr Draghi argues the issue is a political one, not a banking one, which means the bank is going to be very constrained if it wants to act as a bank without the relevant authority. This is the kind of hot potato which is likely to be passed from one desk to the next (Yes, Mr President, but...) with no one really being willing to go down in history as the person who might have torn Europe apart, which leads us to the conclusion that the "muddle through and fudge" stage might last quite a bit longer than many are expecting.

If I Owe You 10 billion I have A Problem, But If I Owe You 300 billion..........

As John Paul Getty famously said, "If you owe the bank $100 that's your problem. If you owe the bank $100 million, that's the bank's problem". Never a truer word was said in the Greek case, and it is the reality that Mr Tsipras and those around him have, I suspect, understood. Now I fully appreciate that the Troika are a group of people who are motivated largely by principles not by money, but when your principles could cost you, and those providing you with the money you spend, 200 billion Euros, 300 billion Euros, or whatever, then dare I suggest there is food for them to think.

Estimates of just how much the Troika are on the hook for should Greece default vary, but a common number is somewhere in the 200 billion euro range. Of course, some of this would eventually be recoverable, one day, and assuming Greece were able to pay, but in the meantime (given the super senior status of the IMF participation) it is highly likely that governments and taxpayers in the other Euro Area countries would need to cover the shortfall, and this, to put it mildly, is unlikely to be popular with voters. Yet another reason for "fudge and muddle through".

There are three main sources of Troika exposure to Greece, bailout loans, sovereign bonds owned by the ECB, and liquidity provided to the Greek central bank thorugh the Eurosystem via what is known as Target2. Now according to estimates by Commerzbank analyst Christoph Weil, between loans and bond purchases Greece owes a total of €194bn, which breaks down into €22bn owed to the IMF, €53bn to Euro Area countries, €74bn to the EFSF and €45bn to the ECB. On top of this there are Target2 liabilities of the Greek central bank vis-à-vis the ECB - and indirectly to the German banks - to the tune of €104bn.

As Christoph says in his report: "It would undoubtedly be bitter for the German government to have to tell taxpayers they would have to fork out €75bn if the debts were not repaid, but the alternative of continuing to throw good money after bad, would not make it any more popular either". Methinks he is being a bit too blasé here, since while it is surely the case that a 75 billion Euro bill for the German taxpayer would cause a furore, I'm not sure he has grasped just what a problem this would then present for continuing with further bailouts as needed with other troubled countries.

Can This Really Be Europe?

Nonetheless, despite the fact that Mr Tsipras would now appear to have Germany's leadership by the short and curlies (something Barack Obama's US advisers will surely have been spelling out to them in Camp David this weekend), it is not at all clear what turn events will take from here on in. History is, after all, often more about the unintended consequences of unexpected accidents than it is about plans.

Nevertheless, several things are clear. In the first place, the Greek economy is in unremitting decline, under the weight of the healing measures being applied by the IMF and its European partners. GDP was down by approximately 17% at the end of 2011 from its Q3 2008 high. Not as steep as the Latvian 25% fall - but then the IMF are still forecasting a further 5% decline in 2012, and without devaluation don't expect any sharp bounce back. Both reputationally and infrastructurally the country is being quite literally destroyed. The medicine has evidently been worse than the illness, and maybe it is just coincidental, but the Marshall Plan type aid which the country now obviously needs was originally applied in Europe following the destruction of WWII.