"On an optimistic view, that a deal was struck implies that neither side was ultimately willing to risk a Greek exit because they recognise that no one fully understands all the ramifications of such a decision. Under this scenario, when pressure again builds, the authorities will do the same: let Greece remain in the euro, even if it fails to keep to its adjustment programme. So, the reality of “bail-out II” means that, if the situation becomes critical, there will be a bail-out III". Sushil Wadhwani, writing in the Financial TimesSo Greece has finally been awarded a second bailout. One may wish the country will live to tell the tale.

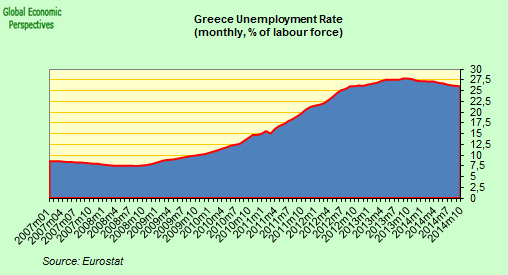

According to IMF DG Christine Lagarde, speaking at the post agreement press conference, "It's not an easy (program), it's an ambitious one,". Never a truer word was said, and certainly not in jest. Not only is the program an ambitious one, it is more than probably a "pie in the sky" one too. The objective of 120% for Greek debt in GDP is totally unrealistic, not because it won't be attained (it won't), but because even if it were the country would still be in an unsustainable situation in 2020. So this is hardly something to be proud of, or look forward to.

And then there is growth. Ah yes, growth. Noone really has any idea how this will be achieved, and of course without it even the (un)ambitious 120% goal is way out of reach. But beyond the details, I have serious doubts whether Greece itself is now rescuable. I don't mean the financial dimension, I mean whether or not the country will even raise its head again. The social fabric and the country's reputation is being so destroyed, that it is hard to see serious investors getting back into the country again, with or without that much needed internal devaluation.

Young people will simply vote with their feet and leave, leaving an ever more unsustainable pension and health system. A common story these days along Europe's periphery, but still, Greece definitely seems destined to be the worst case scenario.

Perhaps the best simple summary of what just happened was written by Annika Breidthardt and Jan Strupczewski in their Reuters report:

"The complex deal wrought in overnight negotiations buys time to stabilize the 17-nation currency bloc and strengthen its financial firewalls, but it leaves deep doubts about Greece's ability to recover and avoid default in the longer term".We have just bought some time for the rest of us, while Greece is sent off to default and beyond. The Troika representatives didn't "sign off" on the new deal, they effectively washed their hands of the whole messy situation. Naturally Greece won't be able to comply with the conditions, and at the next review, or the one after, the country will be face to face with the inevitable.

The Details.

- Greece has agreed to be placed under permanent surveillance by an increased European presence on the ground, and it will have to deposit funds in an escrow account to service its debt to guarantee repayments. effectively this will rule out future defaults against the private sector. This is why Europe's leaders think this agreement will end contagion, there will be nothing to "contage". But the problem simply becomes worse, since any default now will be against the official sector, and they are not nice, friendly people to default on.

- The European Central Bank agreed to help the process by distributing its profits from bond-buying. A Eurogroup statement said the ECB would pass up profits it made from buying Greek bonds over the past two years to national central banks for their governments to pass on to Athens "to further improve the sustainability of Greece's public debt." The bond holdings of the ECB and national central banks from their investment portfolios (about 12 billion Euros) and the Security Markets Programme (around 40-45 billion Euros) are to be swapped for instruments that appear to be exempt from any future Collective Action Clauses. They will be repaid at face value, albeit with an understanding that the profits accruing from this repayment plus coupon payments will be transferred to governments via the various National Central Banks. This money can then be passed to Greece in the form of a transfer. The importance of this arrangement is that it reinforces the subordination of private sector bond holders to central bank buying. Moreover, it is not clear that there is any obligation for the national governments to give these income flows from Greek restructuring back to Greece, and if this proves to be the case this outcome would simply amplify the subordination of private investors.

- Private bondholders are being asked to accept more losses than originally postulated. Private sector holders of Greek debt will take losses of 53.5 percent on the nominal value of their bonds. They had previously agreed to a 50 percent nominal writedown, which equated to around a 70 percent loss on the net present value of the debt. This being said, all is still far from clear. The IMF document detailing the underlying economic assumptions for Greece assumes a 95% participation rate in the PSI. This outcome seems unlikely, especially in light of the increased haircut for private investors in the new deal, which was implemented in order to reduce Greek debt/GDP to the targeted 120% by 2020 from the 129% it would reach according to earlier PSI assumptions. What this implies is that those dreaded Collective Action Clauses may still be needed sometime early next month to ensure no hold-outs, and if this happens it is quite possible that CDS will trigger. So we are not out of the woods yet, it seems.

- The latest IMF document reaffirms its view that Greece is unlikely to be able to access the market in its own name during the programme period until at least 2020, "and it is assumed that financing needs are met by Greece’s European partners on standard EFSF borrowing terms", if good policies are maintained. One problem the IMF mentions here is important, and that is the fact that future debt issuance would be subordinated to the currently being restructured pool of debt. This would obviously make it hard to sell bonds to new investors even in the most favourable of circumstances.

- As if this wasn't enough in the way of headaches, the latest IMF document also suggests that Greece is likely to need additional funding well before 2020. The Fund outlines two scenarios: a "base" case whereby Greece may need an additional 50 billion Euros during the period 2015-20 given that the new 136 billion Euro support package will only meet Greece’s funding needs until 2014. They also cite a more bearish case involving slower-than-targeted growth and fiscal consolidation, whereby debt/GDP only declines to 160% by 2020 rather than the targeted 120%, in which case Greece would require a further 109 billion. Hence far from having put Greece off the EU radar, the new debt deal only marks the end of the beginning, and we still need to get through to the beginning of the end.

- In terms of timescale, the private creditor bond exchange is expected to be launched on March 8 and complete three days later, according to Greek sources. That means a 14.5-billion-euro bond repayment due on March 20 would be restructured, allowing Greece to avoid default.

- We still have no decision on the IMF’s contribution to the new package. Some of the IMF’s non-European board members have been expressing frustration with the continuing need to keep channelling funds to the Euro area – and seem worried that the IMF is taking to big a risk on Greece, as the IMF loans to Greece already far exceed the size of any previous IMF loan package. A figure which has been mentioned is 13 billion Euros and an extension of maturities on existing IMF loans – this contribution will be well below the 30 billion Euros contributed to the first Greek program, and should begin to warn participants that the Fund's tolerance for the inability of Europe's leaders to sort out their problems is going to encounter hard limits at some point.

At the end of the day the important point to note is that the vast majority of the funds in the current program will be used to finance the bond swap and ensure Greece's banking system remains stable; some 30 billion euros will go to "sweeteners" to get the private sector to sign up to the swap, 23 billion will go to recapitalize Greek banks. A further 35 billion or so will allow Greece to finance the buying back of the bonds. As Annika Breidthardt and Jan Strupczewski point out in their article, next to nothing will go directly to help the Greek economy.

The main purpose of exercise - apart from trying to close off contagion - was to reduce Greece's debt to a point that the IMF would be able to continue funding. It will be recalled that the whole second bailout issue was put on the table when the IMF reported that it would be unable to continue with the first bailout since its own regulations stipulated it could not continue with programme payments to a country whose debt path was not sustainable. Their economists must have had to swallow some to be willing to sign off on the sustainability of this one. But such are the political pressures people are facing.

The Sacrificial Lamb

It is hard to remember a time when such an important decision was taken where so many of those participating were expressing the view the solution was not going to work. Thus conservative leader Antonis Samaras, a strong contender to become next prime minister, stressed that the rescue package's debt-reduction targets could only be met with economic growth. "Without the rebound and growth of the economy ... not even the immediate fiscal targets can be met, nor can the debt become sustainable in the long-term."

Hardly inspiring words from the person who is most likely to have to take responsibility for all of this.

Naturally Europe's leaders are more concerned about their own backyard than they are about what actually happens to the Greeks. "It's an important result that removes immediate risks of contagion," Italian Prime Minister Mario Monti is reported as telling a news conference.

Swedish Finance Minister Anders Borg effectively summed the cynicism of the whole position up like this: "What's been done is a meaningful step forward. Of course, the Greeks remain stuck in their tragedy; this is a new act in a long drama. "I don't think we should consider that they are cleared of any problems, but I do think we've reduced the Greek problem to just a Greek problem. It is no longer a threat to the recovery in all of Europe, and it is another step forward."

But as Sushil Wadhwani suggests, rather than overcoming contagion, what the agreement does is give a whole new twist to the issue of contagion. In particular, the general impression that has been generated is that Germany’s leadership will now make almost any concession in order not to have to look for the Euro exit door, and the others, starting with the highly intelligent Mario Monti, are beginning to sense this. Even Spain’s Mariano Rajoy has caught-on, and seen he can negotiate a relaxed deficit target for 2011, despite the fact that the country missed last year’s target by a large margin. So we may well now see a chain of events were one country after another sets out to test the patience of the "core". And in addition (see below), the Greek contagion problem is a long way from being over.

Eternal Life on LTRO "Cool Aid"?

Meawhile, the impact of recent policy changes at the central bank should not be underestimated. In particular, the latest decision to implement two 3 year Long Term Repo Operations has been very important, and is a short term game changer.

Distressed sovereigns can, for the time being fund themselves, even if the commercial banks are only really inclined to bid at the short end, and may well be exaggerating the extent of relief provided by buying short term bonds in an attempt to store liquidity to meet their own future wholesale financing needs.

Basically, the liquidity provided, in conjunction with the all important flexibilisation of the collateral rules, has enabled banks to make provision for their wholesale funding needs right through from now to 2015, at which time there will doubtless be another round of LTROs, and who knows, they could even have a longer term than a mere three years. The days when banks saw it as a stigma to have recourse to ECB liquidity, and when journalists entertained themselves making fun of packaged used car loans being offered as collateral in Ireland by the Australian bank Macquarie are now long gone, as are the times when anyone really imagined that any sovereign bond from a country losing the minimum rating qualification of at least a single A from one agency would not be available for use as collateral at the central bank.

And this liquidity policy knocks yet another of the old chestnut endgames straight out of the window too, since it makes deposit flight within the Euro Area as a whole a much smaller problem. German and other core country deposits can be recycled - via wholesale finance provided at the ECB - as a substitute for the missing peripheral ones. Naturally this measure does not unblock the credit crunch problem, but it does reduce immediate systemic pressure. So, if the Euro system is inherently unstable, and unsustainable, a mire from which no one wants to exit since fear of the unknown always trumps hatred of the known, how does it all finally unwind? The implicit market assumption that Portugal will follow Greece into default comes as no surprise. If Greece is to be given an ongoing debt pardoning programme then surely in Portugal is going to want one too. And then there will be Ireland, and so on. Yet all of this is contemplatable, what is not contemplateable is that the people who live in these unfortnate countries will continue to accept whatever is trown at them, come what may. You only need to look over in the direction of Hungary to see that these no-growth austerity programmes have a sell-by date. But what will follow will surely please no one.

The Club No One In Their Right Mind Would Leave

But what about Greece itself? Logic suggests that they will be unable to meet the terms of their new agreement, and that we will soon be back to where we started, or will we.

Feelings that what we are seeing today will only be a short interlude are based on a combination of three factors: a) a recognition that even a reduction of debt to GDP to 120% by 2020 may well not be sustainable; b) a recognition that after the formal bailout is awarded there will still be ongoing programme reviews, and the country will struggle to comply with the conditions; and c) the fact that the implementation of the Private Sector Involvement debt swap will probably mean changing the jurisdiction under which Greek debt is denominated from mainly Greek law in the majority to international law in the totality. This latter point is undoubtedly the most important, although being able to grasp its full implications implies an understanding of the first two.

Essentially, if the unsustainability of the Greek debt path and the inability to comply with conditionality are accepted, then a further default will be inevitable, but such a default will undoubtedly be a very, very hard one, and most likely an uncontrolled one. In the first place if the country were to leave the Euro after the debt swap, then the new Greek bonds could not be converted to New Drachma (or equivalent) by a weekend session of the Greek parliament, and the country would have to default on bonds denominated in Euros, which would presented them with all kinds of problems.

Secondly, given the terms of the debt swap, and the condition of an escrow fund to protect the interests of private bondholders, then the only liabilities on which the country could still default would be those commitments it has with the official sector, which means defaulting on the IMF, the ECB, the EU and Germany. These would not be especially nice people for the country to default on, since if Greek reaches such a point the country would almost surely be made an example of, which means effectively establishing a pariah state.

The EU certainly wouldn't be sending in the social workers and psychologists to help them cope with this massive tragedy, which also implies that investors generally would be inclined to steer clear. Realising this, and having taken the decision not to default now, short of seeking allies among other rogue states (the North Korea path) the country’s leaders have probably taken the decision to stay in as long as they can. But then it is worth remembering the old Greek saying that “whom the gods would destroy, they first make mad”, by which I mean we could well see extreme factors at play in Greek politics - the extreme right, the extreme left, and the military - before they then all go rolling off the cliff together.

Or maybe Greece will decide to default and stay in the Euro, printing its own Euros at the national central bank along the lines of the Emergency Liquidity Assistance precedent. That would surely create a mighty mess, (they could even carry out the internal devaluation by subsidising Greek wages) and would leave the onus of kicking them out on their European partners.

Whichever the appointed path, such a scenario would have important geopolitical implications, since surely the EU could not let Greece become a nice place, given that then Portugal would immediately say "I want one of those", and so on and so forth along the daisy chain. In the meantime private capital will be steadily forced out of periphery sovereigns like Spain and Italy, and the ECB will ultimately have to provide. But we have already crossed the Rubicon on this, and there is no real turning back. Ongoing debt restructuring will continue, as none of the really troubled economies can either grow or sustain their existing debt. I mean, who can now really believe that Spain won't be asked in six months time to prepare another set of reforms (the latest batch have "destined to fail" written all over them), and six months later another one, and so on, until eventually the country is where Greece is now?

And if the private sector either can’t, or won’t accept the degree of involvement being asked of it, then the ECB will be taken out of the official sector, and somehow or other find a way to swallow the losses. At least that's the way things could work for the time being.

Destroying European Democracy?

The principal issue impeding exit is not the one of the presence of sunk costs from years of membership, but rather existence of non-linear credit and currency impacts - in either one or the other direction – impacts which could not be envisaged in the pre-Euro era during which most of the critics of the common currency cut their theoretical teeth.

The only conceivable way a deliberate decision to leave could actually be taken would be as a result of one or more of the respective agents being actually driven “insane” by the constant painful efforts involved in trying to retain the pin in that grenade they are holding as they are driven to ever more desperate efforts in a vain attempt to try to stop it going off in their face. Could, for example, Hungary’s leader Viktor Orban be about to offer us an early prototype for the kind of road map which some of the participants might need to follow in order to reach the point whereby they actively decide to leave? In Hungary’s case, of course, the departure would be from the EU, not the Euro, but the point is effectively the same, since the farewell party would most certainly acrimonious, where the possibility of regulating the exit would be limited, and where the end product would almost certainly be the creation of a pariah state.

For the inevitably defaulting participants, given the total determination not to have official sector restructuring, leaving the Euro would more or less automatically mean a sharp break with both the EU and the IMF and in all probability the United States. If we take Greece as an example, and assuming the currently proposed PSI debt swap goes forward, the country will almost certainly see the jurisdiction of its debt shifted from national to international law, making converting sovereign debt instruments into New Drachma (or whatever) impossible, and given the creation of an escrow account to pay the private sector creditors, the only meaningful possibilities for default would be against the official sector – the ECB, the IMF and the EU member states – and clearly such a development would not be well received, among other reasons due to the precedents which could be created for other struggling countries who might wish to follow the same path.

So the list of probable allies for an exiting country – Venezuela, Bolivia, and North Korea come to mind, or nearer home Serbia, Belarus and Ukraine – would not be entirely alluring. The difficulty is that after the ending of the cold war, the world is rather short of role models for developed economies who want to pursue unorthodox policies, especially if they are engaged in a disorderly default causing considerable discomfort for most of their “first world” peers..

On the other hand, those with more stable, internationally competitive economies will not readily wish to surrender this condition, and since they have clearly benefited significantly from membership of the currency union they will be unlikely to offer themselves as candidates for departure. In a post Euro world they would face the likelihood of trying to export their way forward while labouring under the constraint of a substantially over-valued currency.

So with no one leaving, and everyone elbowing the other in the rush to say "I'm not going" there really only is one way all this can end, isn't there?